It’s been a superb yr within the inventory market.

Via the shut on Friday, the U.S. inventory market is up 20% in 2024.

The Russell 3000 Index is an efficient approximation of the full U.S. inventory market. The index now has rather less than 2,700 shares.

Out of two,670 shares, 101 are up 100% or extra this yr (3.8% of the full). 13 shares are up 300% or extra, 5 are up 500% or better and there’s one inventory within the one frequent membership, which is up greater than 1,000%.1

Not dangerous.

Curiously sufficient, even in a superb yr for the index, there are many shares which can be down massive too. Greater than 1,000 shares are down this yr or 40% of the full. There are extra shares down 50% or worse this yr (137) than up 100% or extra (101).

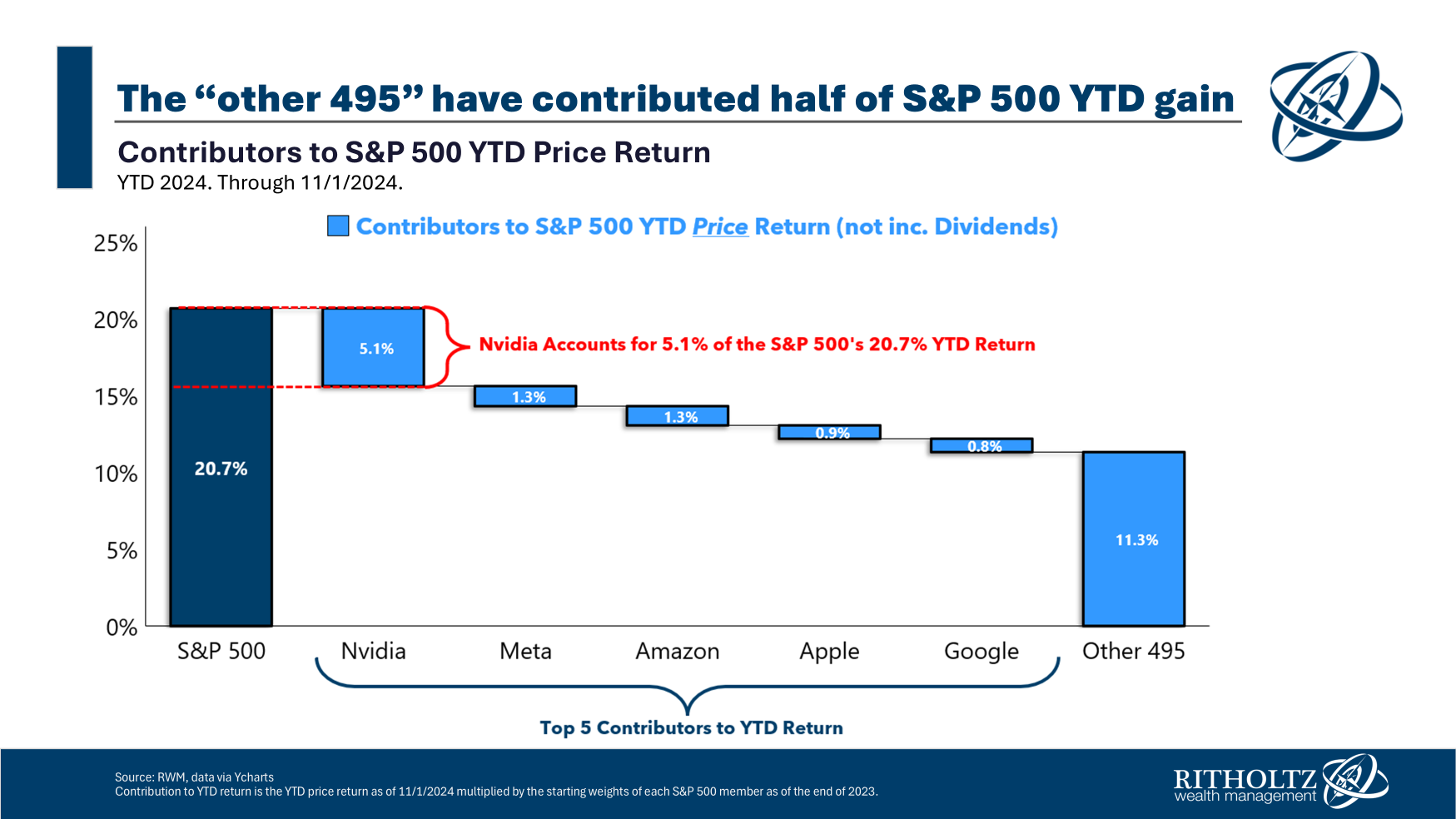

After all, the largest shares are inclined to have outsized management of the returns in a market cap weighted index (by design). 5 shares are answerable for round half the beneficial properties on the S&P 500 this yr:

Nvidia alone makes up one-quarter of the achieve.

I’m performing some analysis for a undertaking on the dot-com bubble of the Nineties, so I made a decision to have a look at the return profile of the inventory market on the peak of the madness in 1999.

The inventory market completed that yr with a 24% achieve however there was loads of silliness beneath the floor.

Almost 350 shares had been up 100% or extra in 1999 (14% of the full). Greater than 100 shares had been up 300% or higher (4% of the full) and an astonishing 13 shares completed the yr with beneficial properties in extra of 1,000%.2

Most of these corporations had been of the dot-com selection as traders went loopy for Web shares.

Greater than 1,000 shares had been down that yr too, together with 182 names that completed the yr with losses in extra of fifty%.

A number of ideas on this information:

There are a variety of shares you’ve by no means heard of. The record of best-performing shares this yr contains corporations similar to Sezzle, Longboard Prescribed drugs, Root Inc., NuScale Energy and Janux Therapeutics. The one firm I acknowledged within the record of high 10 names is Carvana.

Issues might at all times get crazier. I’m not suggesting we’re due for a repeat of the dot-com bubble however finding out historic market extremes gives a pleasant reminder that now we have a behavior of taking issues too far.

Stockpicking is difficult. Most traders solely give attention to the largest winners however even when there are good years within the general market, there’s nonetheless ample alternative to lose massive cash together with your inventory picks.

Lottery winners are extra enjoyable to dream about however it’s uncommon to money these tickets.

Additional Studying:

The Greatest Distinction Between Now & the Dot-Com Bubble

1It’s an organization I’ve by no means heard of known as GeneDX Holdings. It’s up greater than 2,800% on the yr. I’m guessing it’s biotech.

2The perfect performer in 1999 was Qualcomm, which was up near 2,700% on the yr.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will probably be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.