I acquired an e mail from Vanguard notifying me of upcoming adjustments to its price schedule. The one change that stands out for me is that Vanguard could cost $100 efficient July 1 if I switch an account to a different dealer until I’ve $5 million with Vanguard.

I’ve been investing with Vanguard for over 25 years. I’ve had the sensation from some adjustments by Vanguard lately that I’m not as valued as earlier than. This newest announcement lastly pushed me to the inevitable. I submitted a request to switch my account to Constancy earlier than the brand new price takes impact.

Should you’re considering alongside the identical strains, it is best to examine a couple of issues earlier than you switch your accounts out of Vanguard. I’m not suggesting that everybody ought to go away Vanguard. This information is barely for many who intend to switch. It should make your switch from Vanguard go extra easily.

1. Do you have got a taxable account at Vanguard?

Tax-advantaged accounts equivalent to Conventional and Roth IRAs may be transferred to a different dealer with out tax penalties. The switch doesn’t generate a 1099 type. It doesn’t depend towards your annual contribution restrict. Please skip to Step 3 in the event you solely have tax-advantaged accounts at Vanguard.

Transferring an everyday taxable brokerage account wants extra cautious consideration.

2. Price Foundation Methodology Election in Taxable Account

When you’ve got mutual funds (not shares, ETFs, bonds, or brokered CDs) in an everyday taxable brokerage account, it is best to first make certain the price foundation technique of your holdings is ready to Particular Identification (“SpecId”). The default value foundation technique for mutual funds is Common Price. Setting it to SpecId will switch the price foundation of every tax lot while you switch your account. It’ll enable you to reduce taxes while you promote sooner or later. If the price foundation technique continues to be Common Price while you switch, solely the typical value will switch to your receiving dealer and you’ll lose your buy historical past.

This solely applies to taxable accounts. You don’t have to do something with the price foundation technique in tax-advantaged accounts.

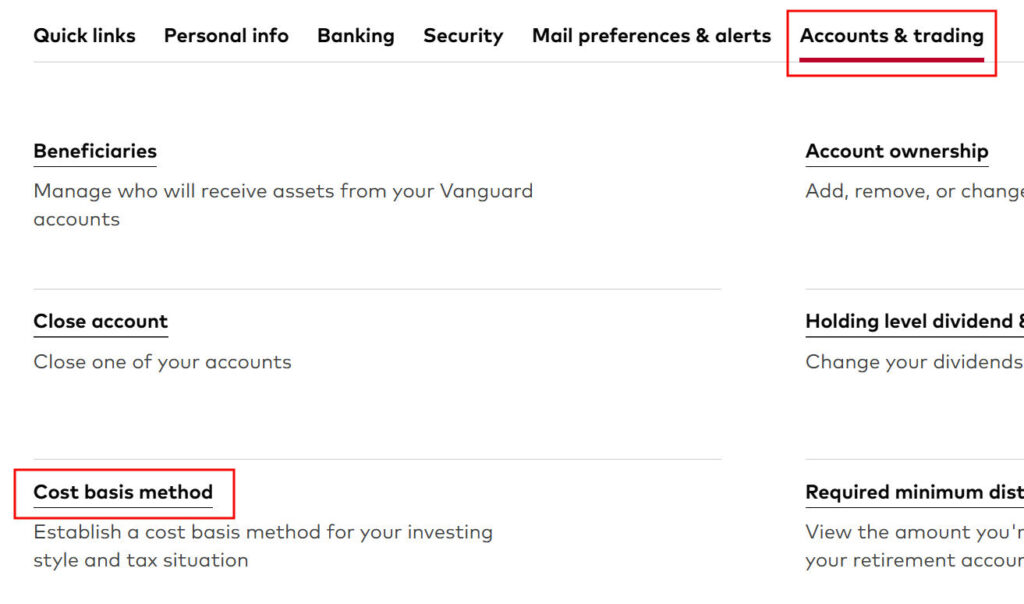

You’ll be able to see or change your present setting in Profile & settings (the pinnacle icon) -> Accounts & buying and selling tab -> Price foundation technique.

The change could take a day or two to finish. Wait till it’s achieved earlier than you proceed.

3. Do you have got Vanguard mutual funds?

Particular person shares, ETFs, bonds, and brokered CDs are all equally accessible at one other dealer. You’ll be able to switch these simply to a different dealer and maintain, purchase, or promote them on the new dealer. Please skip to Step 5 in the event you solely have particular person shares, ETFs, bonds, and brokered CDs in your Vanguard account.

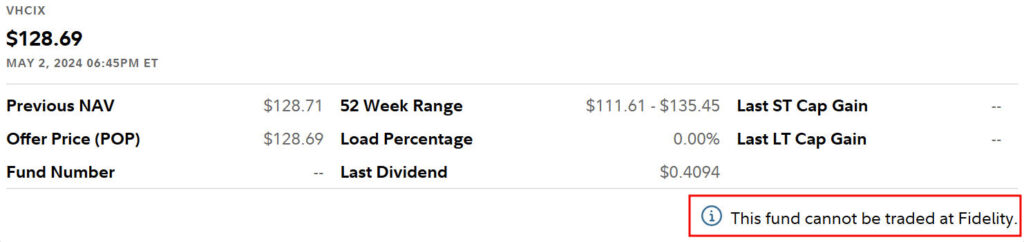

Not all Vanguard mutual funds may be held by all brokers outdoors of Vanguard. Please examine with the receiving dealer to see if they will settle for your Vanguard mutual funds. For instance, in the event you seek for VHCIX (Vanguard Well being Care Index Fund Admiral Shares) on Constancy’s web site, you’ll see a small be aware saying “This fund can’t be traded at Constancy.”

As Steve famous in remark #34, having this be aware doesn’t imply that Constancy can’t settle for it in a switch. Considered one of my funds has this be aware and it transferred efficiently.

In case your receiving dealer can settle for your Vanguard mutual funds, there’s often no cost for holding present shares or routinely reinvesting dividends however you will have to pay a fee while you purchase extra shares of these funds. Constancy and Charles Schwab don’t cost a fee for promoting shares of Vanguard mutual funds you already personal however they do cost for purchasing further shares outdoors of computerized dividend reinvestments. Another brokers cost for each shopping for and promoting.

I’ve Vanguard mutual funds however I’m not shopping for new shares in these funds. I’ll solely maintain, routinely reinvest dividends, and promote my present shares over time. I gained’t incur any charges after I maintain my Vanguard mutual funds at Constancy.

4. Do your Vanguard mutual funds have ETF shares?

In case your receiving dealer can’t settle for your Vanguard mutual funds or if it might settle for them however you wish to purchase extra shares sooner or later in addition to routinely reinvesting dividends, see in case your funds are additionally accessible as an ETF. Search for the fund on Vanguard’s web site. If the fund can be accessible as an ETF, it can say so beneath the title of the fund.

Vanguard can convert most of those mutual funds to the equal ETF tax-free with no price. You’ll have to name Vanguard to transform them to ETF. After your funds are transformed to ETFs, you’ll be able to switch the ensuing ETFs to a different dealer and purchase extra shares of the ETFs on the new dealer.

For instance, Vanguard Well being Care Index Fund Admiral Shares (VHCIX) can be accessible as Vanguard Well being Care ETF (VHT). You’ll be able to switch the ETF and purchase extra shares after you exchange VHCIX to VHT.

Changing to ETF is an possibility however it isn’t at all times obligatory when you’ll be able to switch the fund as-is. You’ll be able to preserve holding the Vanguard mutual funds and solely reinvest dividends and promote at Constancy or Schwab. If it’s worthwhile to purchase extra shares, purchase an ETF or an alternate fund. You’ll have two holdings for a similar asset class however it’s not a giant deal.

There’s a small danger that the price foundation will probably be tousled while you ask Vanguard to transform your mutual funds to ETFs in a taxable account. It shouldn’t occur however you by no means know. I didn’t wish to take that likelihood after I transferred a taxable account from Vanguard. I don’t thoughts solely holding the Vanguard mutual funds, routinely reinvesting dividends, and promoting with no fee at Constancy. I simply gained’t purchase new shares of these funds.

This small danger of messing up the price foundation doesn’t apply to tax-advantaged accounts. I’d convert eligible mutual funds to ETFs in a tax-advantaged account earlier than I switch.

Should you resolve to transform your mutual funds to ETFs in an everyday taxable brokerage account, make sure to full Step 2 earlier than you name Vanguard. If a mutual fund continues to be on the Common Price technique when it will get transformed, the transformed ETF will solely have the typical value.

Some Vanguard funds aren’t accessible as an ETF. 4 Vanguard funds have an equal ETF however they will’t be transformed to the ETF:

- Vanguard Complete Bond Market Index Fund (VBTLX)

- Vanguard Quick-Time period Bond Index Fund (VBIRX)

- Vanguard Intermediate-Time period Bond Index Fund (VBILX)

- Vanguard Lengthy-Time period Bond Index Fund (VBLAX)

Should you switch your account, shopping for new shares of those funds will doubtless incur a fee on the new dealer. You’ll have to search out an alternate. Some Vanguard funds not accessible as an ETF are nonetheless one of the best of their class. For instance, Vanguard cash market funds and muni bond funds constantly have decrease bills and better yields than related Constancy or Schwab funds. Some retirees additionally just like the Vanguard Wellington and Wellesley funds. Possibly it is best to preserve your account at Vanguard if you’ll purchase extra shares of these funds.

5. Put together the Receiving Account

Should you resolve to switch however you don’t have already got an account of the identical kind on the receiving dealer, it’s higher to create one forward of time and configure it to the proper settings. The account kind ought to match (Conventional-to-Conventional, Roth-to-Roth, taxable-to-taxable). The account title must also match (individual-to-individual, joint-to-joint, trust-to-trust). In the event that they don’t match, please repair them on both aspect first.

Some brokers pay a bonus for incoming transfers. It’s important to enroll particularly for the bonus and have it coded to your account. I gained’t switch to a dealer just for the bonus however I’ll take the bonus if I already wish to switch to that dealer and it occurs to pay a bonus. Please ask your assigned rep on the receiving dealer you probably have one.

Dividend reinvestment and value foundation monitoring technique to your incoming switch will observe the settings within the receiving account. Have a look and set them to your desire earlier than your investments are available in. The price foundation monitoring technique for mutual funds is ready to Common Price by default in a brand new account. Change it to Precise Price, Recognized Price, or one thing to that impact for higher management over taxes in a taxable account. Should you don’t change the setting away from Common Price, the price foundation of your incoming funds could also be recalculated to the typical value.

I routinely reinvest dividends and use the default value foundation technique in tax-advantaged accounts. In a taxable account, I routinely ship the dividends to the spending account and use Precise Price for the price foundation and Constancy’s Tax-Delicate lot disposal technique. Charles Schwab calls them Recognized Price and Tax Lot Optimizer.

Beneficiary settings in your Vanguard account gained’t come over with the switch. Set your beneficiaries within the receiving account earlier than you switch.

6. Watch for The whole lot to Settle

When you’ve got current transactions in your Vanguard account (cash in, cash out, trades, changing mutual funds to ETFs), it is best to look forward to every little thing to settle earlier than you switch your account. It’s simpler for everybody in the event you switch when nothing is within the air.

Don’t promote your investments to money forward of time earlier than you switch. Doing so in a taxable account will set off capital positive aspects and taxes. Promoting in a tax-advantaged account will make you miss out on positive aspects if the market occurs to surge when you look forward to the switch. Constancy and Schwab don’t cost for promoting Vanguard mutual funds after your switch is accomplished.

7. Save Price Foundation Particulars of Taxable Accounts

It’s essential to maintain the price foundation information correct while you switch a taxable account. You need to save or print your value foundation particulars in your Vanguard account earlier than you switch. This doesn’t apply to tax-advantaged accounts.

You see these particulars beneath Portfolio -> Price foundation.

Develop “Present lot particulars” beneath every holding. Save the web page to a PDF or print it.

8. Save Account Quantity and Latest Assertion

You’ll want to provide your Vanguard account quantity and a current assertion while you switch your account. The statements are beneath Exercise -> Statements.

The assertion doesn’t present your full account quantity. You’ll want to copy your account quantity and put it aside individually.

9. Request Switch of Belongings on the Receiving Agency

You need to provoke the switch on the receiving agency. The method is often on-line. It’s beneath Accounts & Commerce -> Transfers after which “Transfer an account to Constancy” in Constancy. Search for one thing related at different brokers.

You’ll be requested the place you’re transferring from, the account quantity on the sending agency, what kind of account it’s, whether or not you’d prefer to switch every little thing within the account or solely a part of it, which account you’re transferring into, and eventually to connect a current account assertion of the supply account.

Should you’re requested whether or not you’d prefer to switch in-kind or promote and switch money, make certain to decide on in-kind. In-kind means transferring every holding as-is with none change. Solely transferring in-kind gained’t set off taxes in a taxable account.

The switch often takes every week or sooner to finish. My switch accomplished in 4 enterprise days.

Many locations ship an alert while you log in from an “unknown gadget” today however I didn’t hear something from Vanguard when my total account went out of the door. Vanguard didn’t ship any affirmation or alert after they acquired the switch request to stop fraud. Nor did they ship any warm-hearted parting message to probably welcome me again sooner or later or any exit survey to ask the place they might’ve achieved higher. It shattered all my phantasm that I used to be a valued buyer/proprietor.

10. Confirm Price Foundation in Taxable Account

If the switch is profitable, the holdings will come over first with out the price foundation particulars. That’s regular. Vanguard will ship the price foundation particulars in one other week or two. You need to confirm the price foundation particulars towards the information you saved in Step 7.

11. Residual Sweep

Should you do a full account switch and any of your investments pays dividends or curiosity throughout or after the switch, the dividends and curiosity should go into your previous account. There will probably be one other computerized sweep to switch any residual quantities. You don’t must provoke it. It should come over in a couple of weeks.

12. 1099 Types Subsequent 12 months

Your Vanguard login nonetheless works after you switch your account. You’ll nonetheless get the 1099 kinds subsequent 12 months from Vanguard for any actions that occurred earlier than the switch. Set a calendar reminder to obtain the 1099 kinds from Vanguard subsequent 12 months.

***

Transferring a Vanguard account isn’t troublesome however it requires some planning, particularly while you’re transferring a taxable account with mutual funds. Typically it’s higher to not switch. A very powerful elements are to not promote something and set off taxes and to protect the price foundation information for particular person heaps in taxable accounts.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.