They are saying to not time the market. It’s a chump’s sport. If anybody had any actual success at it, they’d be wealthy.

This sort of recommendation sometimes applies to the inventory market, however it could possibly apply to absolutely anything else too.

It’s arduous sufficient to foretell one thing to occur at any given time. And exponentially more durable to foretell one thing to occur in a brief window of time.

In different phrases, don’t hassle. Don’t attempt to time it. It received’t go as anticipated.

Relating to residence shopping for, the identical holds true. However in contrast to investing, there are such a lot of components to contemplate past value.

Now That Charges Are Decrease, You No Longer Must Beat the Rush?

It’s humorous how the media jumps onto sure narratives, runs with them, exhausts them, after which strikes on to the subsequent one.

All whereas forgetting about (and primarily ignoring) the prior one within the course of. It’s, for an absence of higher phrases, outdated information.

That piece of outdated information was the argument that it made sense to dive into a house buy whereas mortgage charges and residential costs have been excessive, earlier than the herd adopted.

Merely put, there’d be much less competitors for those who bought when nobody else was, and you may snag a house earlier than the others inevitably got here after you and bid up the value.

Regardless of paying a excessive value and getting an equally costly mortgage charge, there was the promise of a decrease charge within the close to future due to a charge and time period refinance.

There was even a cute catchphrase floating round saying to marry the home, date the speed.

In different phrases, lock down the property now, however finance it with a mortgage you solely plan on protecting for a 12 months or two earlier than charges get less expensive.

That brings me to a brand new piece of recommendation floating round housing information circles; that you simply would possibly need to wait slightly bit longer.

‘You Would possibly Not Wish to Buy a Dwelling Simply But’

Gone is the beat the gang to purchase a home recommendation. It might have made sense on the time, logically talking.

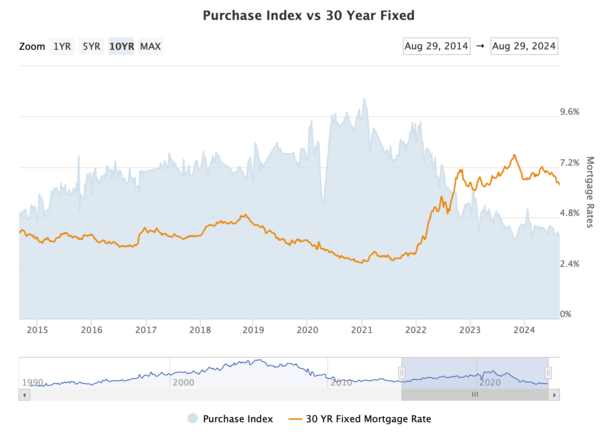

When mortgage charges almost tripled from sub-3% ranges to round 8%, demand plummeted.

Other than turning off a whole lot of potential patrons, it merely made a house buy unaffordable for many.

Should you nonetheless had the means to make the leap, it may have meant much less (or no) competitors and probably an accepted bid under asking.

Nevertheless, this mentality was nonetheless primarily based on timing the market. Had been you shopping for a house since you needed to, or just to beat the “rush?”

And would that rush ever truly materialize? Or have been you catching a falling knife and getting caught with a excessive mortgage charge within the course of?

Effectively, now that we benefit from hindsight, we all know that mortgage charges didn’t come down rapidly, nor have they arrive down as a lot as anticipated.

Sure, they’re decrease, however not the place many anticipated them to be by now. On the identical time, residence costs have continued to extend, at the least nationally.

Some pockets of the nation have seen costs drift off their all-time highs as provide has ticked up.

However maybe most significantly, there was no rush. There wasn’t a significant uptick in demand, as seen within the chart above, when mortgage charges started to fall. And there nonetheless hasn’t been.

Actually, the Mortgage Bankers Affiliation (MBA) identified that mortgage charges have fallen for 4 consecutive weeks, but buy functions haven’t moved a lot greater.

MBA Vice President and Deputy Chief Economist Joel Kan mentioned, “Potential homebuyers are staying affected person now that charges are shifting decrease and for-sale stock has began to extend.”

Huh? They have been instructed to hurry to purchase when charges have been excessive and now they’re not shopping for when charges are almost 1% decrease than a 12 months in the past? And are as an alternative being instructed to attend?

How Did We Not See This Coming?

Looking back, it appears completely apparent that when mortgage charges started drifting decrease with any conviction, potential residence patrons would watch for even higher.

It’s predictable human psychology. Should you suppose one thing goes to get cheaper, why bounce in now?

Would you e-book an airline ticket or a lodge room in the present day for those who count on the value to return down subsequent week or subsequent month?

Why not simply watch for issues to really get higher? Effectively, that was the recommendation being dished out final 12 months, that you simply wanted to beat the herd.

Get in earlier than the house shopping for frenzy returns. Nevertheless it doesn’t seem that many are heeding that recommendation anymore. Or in the event that they ever did to start with.

And which may converse to higher points within the housing market. For one, affordability stays very restrictive, with costs and charges nonetheless fairly elevated.

There’s additionally the notion that the housing market isn’t as sound as as soon as thought, particularly if we’re on the point of one other recession.

Whereas it’s far and away higher than the one which preceded it within the early 2000s, the broader economic system can nonetheless wreak havoc.

If unemployment continues to rise, it received’t matter if mortgage charges drift even decrease from right here.

You would wind up in a scenario the place you might have fewer eligible patrons, counteracting the advantage of a less expensive mortgage cost.

That is one thing many don’t have a tendency to understand or anticipate.

As I’ve mentioned many occasions, residence costs and mortgage charges aren’t negatively correlated. Their relationship isn’t properly outlined. One doesn’t go up as the opposite goes down.

Bear in mind, weak financial information tends to result in decrease mortgage charges as bonds turn out to be a secure haven for traders and their demand will increase. Bond costs go up and their yields (rates of interest) go down.

So it’s completely doable (and logical) for mortgage charges and residential costs to fall collectively, even when decrease funds would seemingly improve demand.

It’s Not About Mortgage Charges Anymore…

Finally, the housing market story is not about mortgage charges. It was a 12 months in the past, however it’s not in the present day. And that’s what makes it troublesome to leap on these narratives.

The second you suppose you’ve received it found out, issues fully shift, typically in an surprising method.

Simply have a look at the pandemic. We thought the housing market had topped again in 2019 or earlier. Then COVID got here alongside and residential costs rose one other 50%.

Who noticed that coming? And who predicted that mortgage charges would surge to eight% in lower than two years?

So cease shopping for into methods that try and time the market. You’ll simply wind up disillusioned.

If you wish to purchase a house, purchase a house that you simply love, need/want, and are capable of qualify for now and sooner or later.

Don’t exit and rush to purchase a house at a sure time as a result of an article says it’s a good suggestion.

Maintain Studying: 10 Causes to Purchase a Home Different Than for the Funding