Esther Afua Ocloo, a younger girl who reworked a mere sixpence into 12 jars of marmalade, marking the genesis of her entrepreneurial journey, ultimately emerged as considered one of Ghana’s foremost enterprise leaders and a staunch advocate for ladies’s financial participation. As Ladies’s World Banking’s inaugural chairwoman, she etched her title in historical past. On April 18th, marking what would have been her a hundred and fifth birthday, we pay homage to her pioneering spirit in microfinance, embodying resilience, willpower, and a worldwide influence.

Born into modest beginnings in Peki-Dzake, Ghana, in 1919, Esther’s narrative unfolded amidst trials and triumphs. Despatched off to Accra by her tearful mom with scant assets, she pursued schooling with unwavering resolve. Leveraging 10 shillings, value lower than one United States greenback, she ventured into marmalade manufacturing, dealing with ridicule however forging forward with unwavering willpower. Reinvesting income, she scaled her enterprise, securing contracts and establishing Nkulenu Industries, diversifying into numerous meals merchandise.

However Esther’s imaginative and prescient prolonged past private success; it encompassed the empowerment of girls at massive. After six years, she had saved sufficient cash to go to Britain to check meals know-how, preservation, vitamin and agriculture. She additionally realized leatherwork and lampshade-making within the hope of sharing the talents with rural ladies again dwelling. Whilst she continued operating her personal firm upon her return, she devoted an increasing number of of her time to bettering ladies’s financial scenario. For instance, she established her personal program on a farm to coach ladies in agriculture, getting ready and preserving meals merchandise and making handicrafts.

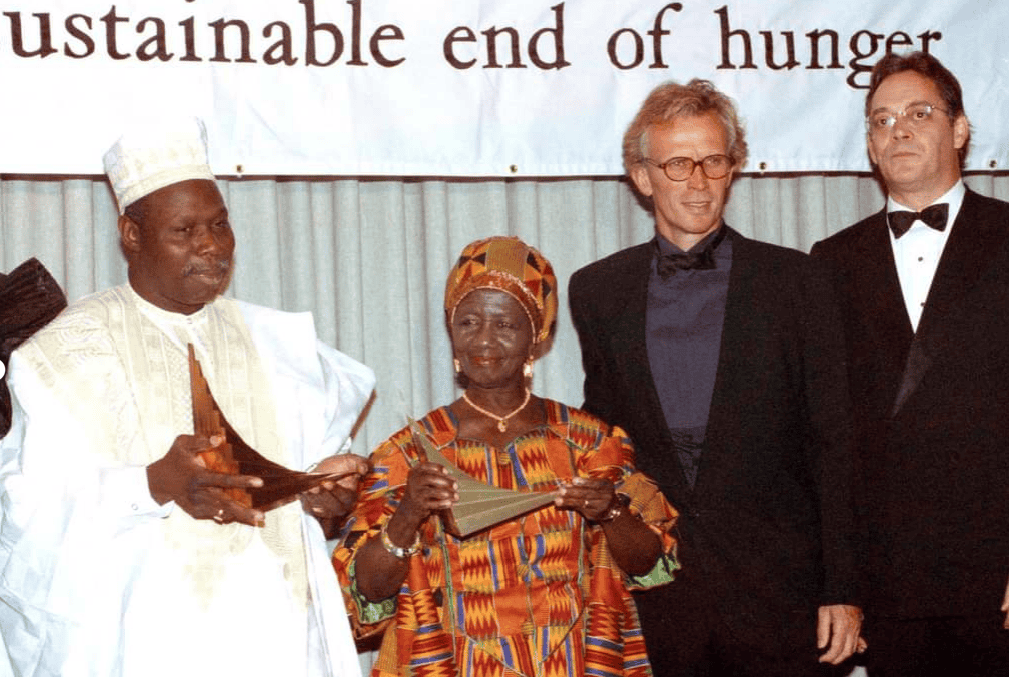

She paid for this system partially together with her half of the Africa Prize, a $100,000 award she break up with Olusegun Obasanjo, the present president of Nigeria, in 1990. It was introduced by the Starvation Venture for his or her management in working to finish starvation in Africa.

”I’ve taught them to value the issues they promote and decide their income,” she mentioned. “You understand what we discovered? We discovered {that a} girl promoting rice and stew on the facet of the road is making more cash than most girls in workplace jobs — however they aren’t taken critically.”

Recognizing the transformative energy of financial independence, she grew to become an advocate for ladies’s financial empowerment. In 1975 on the UN’s First Ladies’s Convention in Mexico Metropolis, Ms. Ocloo discovered that concepts she had been creating with ladies in Ghana had been additionally percolating elsewhere. The premise was easy: greater than schooling, well being care or household planning, ladies in poor nations want entry to capital.

Just one 12 months earlier than the Convention, ladies within the US couldn’t have their very own checking or financial savings accounts with out their husbands’ signatures. That fundamental proper wasn’t legalized till 1981 in India and 1985 in Ghana. As a rainstorm subsided outdoors, one girl from Wall Road noticed a clearing by difficult the established order. She stood up and acknowledged, “Ladies need to personal their very own banking accounts.” Esther was already in violent settlement. Concepts poured from her friends after that. This straightforward but profound assertion planted the seed for one thing extraordinary – the primary nonprofit targeted solely on ladies’s financial empowerment by way of monetary inclusion, beginning with a dedication to assist ladies entry credit score and their monetary futures.

Alongside visionaries like that one girl from Wall Road, Michaela Walsh, and Ela Bhatt, Indian cooperative organizer (SEWA) and Gandhian, she laid the groundwork for WWB—a company devoted to creating finance work for ladies.

Again in Ghana, Esther’s affect reverberated by way of the institution of Ladies’s World Banking Ghana (WWBG) in 1982. As its co-founder and a driving drive, she spearheaded initiatives to combine philanthropy and enterprise, demonstrating the transformative potential of sustainable establishments in uplifting ladies’s lives.

Esther, who at all times wore shiny African garments and cherished to cook dinner conventional meals, most well-liked to be generally known as Auntie Ocloo, within the Ghanaian custom. She normally started conferences of bankers and others with a prayer, and sometimes ended them with a tune: ”We Are Great.”

Days earlier than she died, she was on the telephone from her hospital mattress to governmental officers arguing that microloans, moderately than grants, must be laid out in Ghana’s new price range.

As we rejoice Auntie Ocloo’s life and legacy, allow us to reaffirm our dedication to carrying ahead her imaginative and prescient of a world the place each girl has the chance to thrive. Via our collective efforts, could we honor her reminiscence and be sure that her legacy of empowerment and resilience endures for generations to come back.

Ladies’s World Banking has modified the lives of tens of millions of girls, reworking their households, companies and communities, and driving inclusive progress globally by way of monetary inclusion.

Right now, utilizing our refined market and shopper analysis, we flip insights into actual motion to design and advocate for coverage engagement, digital monetary options (see Blanca’s story right here), office management applications, and gender lens investing.

Assist us attain the almost billion ladies nonetheless excluded from the formal monetary system. Donate now.