The opposite day I seen that mortgage charges have been being marketed at some actually low ranges.

Many quotes within the mortgage fee desk alone web site have been within the mid-5s.

That acquired me curious how low charges might be with a extremely favorable mortgage state of affairs, akin to a 760+ FICO, 20% down residence buy, owner-occupied, single-family residence.

So I headed over to Zillow’s Mortgage Market to see what I might provide you with.

Understanding that VA mortgage charges are usually the bottom, I threw that in too and lo and behold, noticed 30-year mounted charges that started with a “4.”

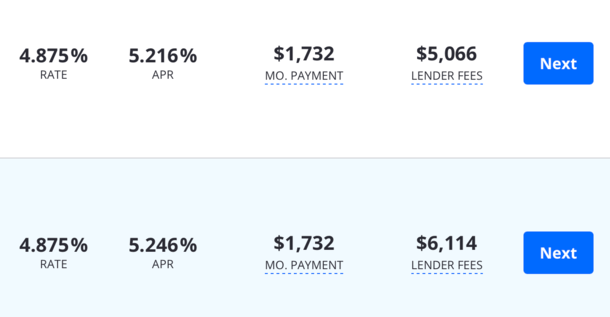

I threw the screenshot up on Twitter and easily mentioned, “Guys, it’s not a mortgage fee story anymore.”

What Did I Imply?

The tweet acquired a superb quantity of traction, doubtless due to these very low 4.875% 30-year mounted fee quotes within the screenshot.

And a few felt it was deceiving to submit charges like that, which could not be reflective of your complete borrower universe in the meanwhile.

In any case, not everybody has a 760 FICO rating or the flexibility to place down 20%, nor may they be eligible for a VA mortgage.

I additionally threw in two low cost factors, since a lot of the low charges marketed at present require the borrower to pay some cash at closing so as to get hold of a “below-market” fee.

In actuality, you may put nothing down on a VA mortgage and get the identical pricing since there aren’t mortgage pricing changes on such loans. The identical goes for having a decrease FICO rating.

So the mortgage state of affairs wasn’t as loopy arduous to qualify for because it first appeared. And after I re-ran the state of affairs at present you can truly get a fee of 4.75% with only one low cost level.

However that wasn’t even the purpose I used to be making an attempt to make. It wasn’t a couple of 4.875% fee vs. 4.75% fee, or a 5.25% fee. Or any particular fee in any respect.

It was that the excessive mortgage fee story we’ve been fixated on for the previous two hours is over.

The housing market at present is now not being pushed by the excessive fee story. We exhausted it, first being caught off guard by how shortly charges elevated in early 2022.

Then questioning how excessive they may go, in the event that they’d hit a brand new twenty first century excessive (they didn’t!).

That was adopted by pondering once they’d start to fall once more (they peaked final October and have dropped fairly a bit since then).

And so it’s not about charges anymore.

If It’s Not Charges, What Is It Now?

That brings me to my level. The housing market is now at a crossroads the place excessive mortgage charges are now not the main focus.

Most potential residence patrons at present will see that mortgage charges have come down considerably.

The 30-year mounted was mainly averaging 8% simply earlier than final Halloween, and at present is nearer to six.25%.

As I illustrated with some mortgage fee buying, it’s additionally attainable to carry down that fee to the excessive 4% vary, or the very low 5s, even for conforming loans backed by Fannie and Freddie.

This implies anybody who has been pondering a house buy through the previous couple years is now not obsessive about charges.

As an alternative, they’re doubtless contemplating different elements, akin to residence costs, the price of insurance coverage, their job stability, the broader financial system, and even the election.

In the event that they have been houses when charges have been nearer to eight%, they’re certainly nonetheless trying with charges approaching 5% (they might be there quickly with out all the right FICO scores and low cost factors).

But when they’re now not trying to purchase, or they’re having doubts, it’s not due to excessive mortgage charges anymore. These are now not guilty.

Maybe now they’re frightened that asking costs are too excessive and will fall. Possibly they’re involved that the financial system is on shaky floor and a recession is coming.

In any case, there’s an expectation that the Fed goes to chop its personal fed funds fee 200 foundation factors over the following yr.

That doesn’t precisely exude client confidence.

We Lastly Get to Discover Out!

What I’m most enthusiastic about now that top mortgage charges are previous information is that we lastly get to “discover out.”

By that, I imply we get to see how this housing market performs in a interval of slowing financial progress, with Fed fee cuts and a attainable recession on the desk.

Keep in mind, the Fed wouldn’t be chopping charges in the event that they weren’t frightened about rising unemployment and a softening financial system.

In different phrases, we’re going to see what this housing market is admittedly product of. As I’ve mentioned many occasions earlier than, there’s no inverse relationship between mortgage charges and residential costs.

One doesn’t go up if the opposite goes down. And vice versa. We already noticed residence costs proceed to rise as mortgage charges jumped from 3% to eight%.

So is it attainable that each mortgage charges and residential costs might fall in tandem? Positive. Granted nominal residence value declines aren’t frequent to start with.

However we’re lastly going to place it to the check. And I’m trying ahead to it.

(picture: Brittany Stevens)