A reader asks:

Ben used the Seinfeld tipping over the Coke machine analogy a number of weeks in the past to explain the buyer and financial system. Does the identical factor apply to the inventory market. Hear me out: The yen/carry commerce debacle a number of weeks in the past was the preliminary push. Then yesterday NVDA fell virtually 10% whereas the market was down 2%. Are we getting nearer to the Coke machine (inventory market) falling over?

One of many causes Seinfeld has endurance all these years later is a lot of the present stays related to life experiences. Right here’s the Coke machine analogy I discussed on Animal Spirits a number of weeks in the past:

Jerry was speaking about break-ups. I used to be speaking about client spending. This query is in regards to the inventory market.

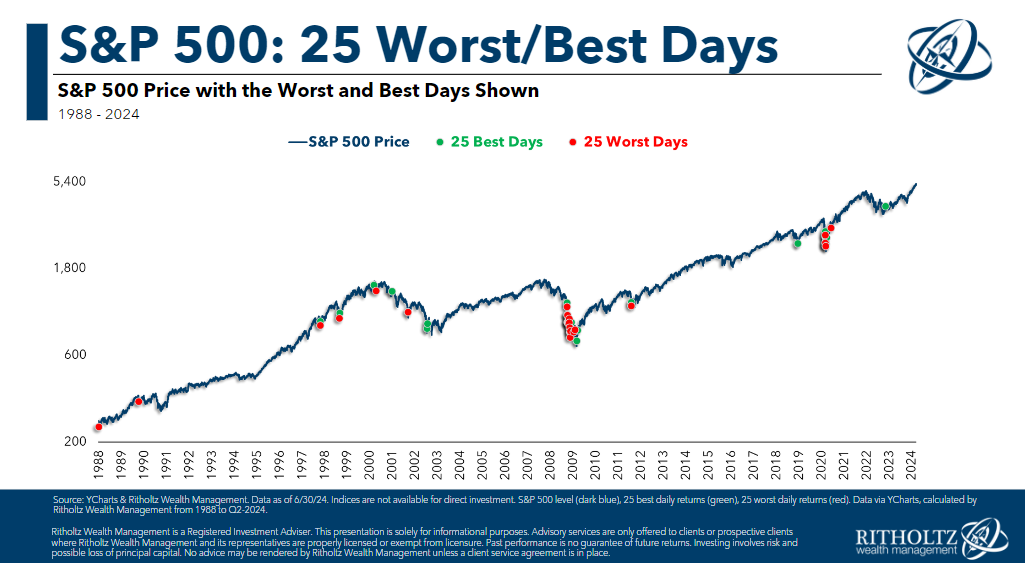

There’s something to the concept volatility clusters throughout downturns. Check out the 25 finest and worst days on the S&P 500 going again to 1988:

The inexperienced and crimson dots are all pretty shut to at least one one other. It’s not such as you see all inexperienced in the course of the bull markets and crimson throughout bear markets.

Sometimes, bull markets are boring. Uptrends are likely to happen in gradual, methodical strikes larger. The massive down days and huge up days normally occur in downtrends as a result of that’s when investor feelings are excessive.

Individuals panic promote and panic purchase throughout corrections, bear markets and crashes.

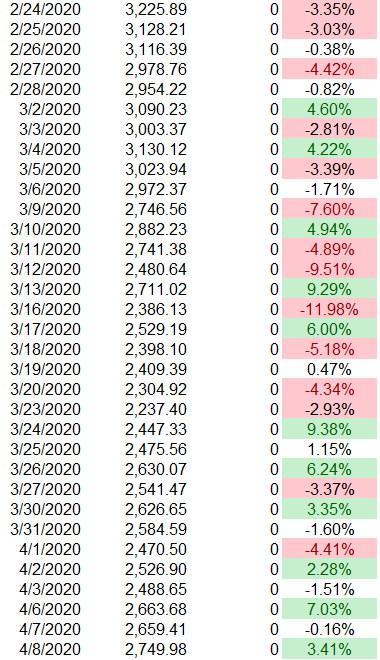

I’ve this spreadsheet the place I hold observe of the each day value strikes, new all-time highs and drawdowns for the S&P 500 going all the way in which again to the Nineteen Twenties. Right here’s a have a look at the each day value motion in the course of the preliminary days of the pandemic in early-2020:

I’ve a color-coding system for the large features and losses, of which there have been many.1 That is an excessive instance however it exhibits throughout a sell-off the inventory market usually has enormous features blended in with the nasty losses.

Up to now month we’ve now had a down 3% day, and up 2% day and a down 2% day. This minor uptick in volatility could also be a harbinger of worse issues to come back within the inventory market. A downtrend has to start out from someplace.

Markets have been working robust for a while now some one other correction wouldn’t shock me.

The monetary media appears to assume the inventory market has its ear to the bottom of a coming financial slowdown. Listed here are some headlines from Tuesday’s down day:

The inventory market has predicted 5 of the final one recession however that is one other risk. The financial system was working scorching. The Fed raised charges. They could be too gradual to decrease them which might worsen the financial system.

The inventory market is forward-looking.

One other clarification is typically shares simply go down and there isn’t motive for it. Right here’s a have a look at the variety of huge down days on the S&P 500 over the previous 20 years:

There are greater down days in the course of the years with giant drawdowns (2008, 2020, 2022, and so on.) however there are additionally huge down days whenever you don’t have a market crash.

The U.S. inventory market has been up 8 out of the previous 10 years (together with 2024). In these 7 of these constructive years (I’m excluding 2020 right here), the inventory market has fallen by 1% or worse each day 23 instances, on common.

Out of 252 buying and selling days within the yr, that’s roughly 10% of the time. So even within the comparatively calm up years within the inventory market, one out of each 10 buying and selling days was a giant down day. In those self same years, the common variety of 2% or worse days was 4. This yr there have been three 2% or worse down days.2

To recap, our three potential situations proper now are:

- The inventory market wants a breather.

- The inventory market is predicting a slowdown within the financial system.

- The inventory market must fall typically and it doesn’t imply something.

I don’t know which situation will play out as a result of I don’t know what the longer term holds.

The inventory market is a manic depressive within the short-run so it’s usually troublesome to discern its intentions.

In the event you can’t deal with a 2% loss each occasionally, you in all probability personal too many shares to start with.

Massive down days include the territory.

We talked about this query on this week’s Ask the Compound:

The OG monetary blogger Barry Ritholtz joined me on the present this week to debate questions on what the subsequent recession will appear to be, creating an funding plan for a banker with money on the sidelines, paying down a low rate of interest mortgage and promote your vehicle.

Additional Studying:

The Minsky Market

1It’s fairly apparent however crimson for losses of two% or worse and inexperienced for features of two% or extra.

2All 3 have come because the finish of July.