Folks spending much less to to allow them to pay mortgage

Australian debtors in Western Sydney have “rallied across the dwelling” and targeted on paying their mortgage throughout instances of price rises and monetary stress, in response to West Aspect Capital managing director Tony Nguyen.

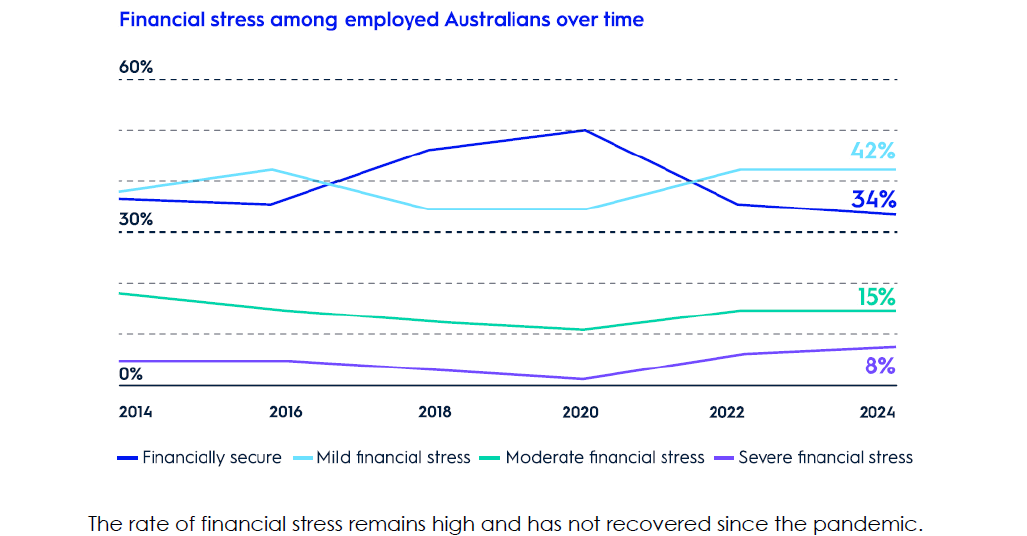

AMP’s Monetary Wellness report, which surveyed 2,475 Australians aged 18 and over in July2 2024, discovered monetary stress ranges in Australia are actually at their highest level in 10 years, with only one in three presently feeling financially safe.

Nguyen (pictured above left), who companies primarily PAYG wage incomes shoppers and SME enterprise house owners dwelling in Western Sydney, stated he had observed proof of stress as rates of interest rose.

“We did obtain much more calls because the rates of interest began going up and other people have been in a panic and whatnot, understanding what they’ll do and what their choices have been, that kind of stuff,” Nguyen stated. “So [financial] stress from that perspective was obvious.”

Nonetheless, he stated what he had observed greater than something was that his shoppers, and Australians basically, have been fairly resilient, and that in distinction to “doomsday situations” most had simply been spending much less.

“They did precisely what the RBA supposed. They spent much less as an entire.”

Nguyen stated that, as lots of his shoppers have been good savers, they have been additionally in a position to faucet into financial savings. Whereas these had been depleted, it had allowed them to climate the rate of interest hikes.

“Everybody simply rallied across the dwelling, they needed to guard their dwelling, and so they simply spent much less elsewhere.”

Australians are responding to the powerful monetary atmosphere by spending much less – the report discovered one in three Australians had cancelled streaming subscriptions and gymnasium memberships.

AMP Financial institution group govt Sean O’Malley (pictured above proper) stated the monetary insecurity uncovered by the report was not stunning given value of dwelling pressures and housing unaffordability challenges being confronted.

“And whereas the analysis tells us that almost all are assembly their mortgage repayments, we all know that financial savings charges are down and lots of are slicing again expenditure on family fundamentals resembling groceries, and different extra discretionary gadgets resembling streaming companies and holidays,” O’Malley stated.

Supply: AMP Monetary Wellness Index, July 2024

When it got here to dwelling loans, debtors had targeted on assembly their repayments.

“It’s an adage, isn’t it, that it all the time appears onerous till you do it,” Nguyen stated.

“There was a little bit of panic, when individuals have been saying, ‘How can I afford it?’. Effectively, guess what? They did afford it. In terms of their dwelling, you don’t promote your own home simply because the charges go up, you’re considering of different methods to maintain your own home.”

AMP discovered stress ranges have been additionally rising for these incomes between $100,000 and $500,000, with one in 4 on this revenue bracket both ‘severely’ or ‘reasonably’ financially pressured.

Nguyen prompt a few of these debtors could have been seduced by “life-style inflation”.

“Managing cash is an artwork type. Some individuals have it. Some individuals do not. Simply because you have got extra of the revenue does not imply you are a greater cash supervisor,” he stated.

Position for brokers to coach shoppers

AMP discovered many individuals have been specializing in short-term monetary calls for quite than long-term planning, with one in three Australians saying they by no means or not often deliberate for his or her monetary future.

One in three Australians are additionally nonetheless not utilizing any info sources in any respect to tell essential monetary selections, even simply accessible info resembling podcasts, social media, or Google.

This might present a possibility for finance brokers to help consumer training, although Nguyen stated that his strategy to consumer service was all the time the identical, whether or not charges have been going up or down.

“You all the time should be ready the place you interact with us and we can assist assessment your charges regularly. As a result of we do this, the message has all the time been the identical,” he stated.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!