A reader asks:

Please assist settle a disagreement my buddy and I are having: He says he’d reasonably the inventory market solely go down somewhat bit after which go up a gentle quantity yearly throughout his working years as a result of recovering from a 30% drawdown in your present portfolio can be tough. I’d reasonably purchase shares on sale. I’d want the market be down 30% for the following 5 years, which can permit me to acquire shares at a reduction. Then after I retire have the market rip for the following 10+ years. Are you able to assist mathematically show which state of affairs makes probably the most sense?

I really like the truth that these associates are having inventory market disagreements. These are my folks.

This can be a good query for the present setting too.

There have been 46 new all-time highs on the S&P 500 this 12 months. The market retains going up.

In 2022, there was only a single new all-time excessive on the primary buying and selling day of the 12 months. From there, the market simply stored happening.

So what’s the higher state of affairs — investing with drawdowns early in your profession or a gentle state the place issues simply maintain going up?

It actually is dependent upon what stage you’re in of your investing lifecycle.

The present market setting is great if you happen to already personal a bunch of monetary property. Child boomers ought to love these new all-time highs as a result of they’ve been invested for thus lengthy and are in or approaching retirement.

You don’t need drawdowns early in your retirement years since you don’t need to be compelled to promote shares whereas they’re down. Sequence of return danger generally is a drawback if in case you have dangerous timing or not sufficient diversification to see you thru an early tough patch within the withdrawal section.

In case you’re a teenager who can be making contributions for years to come back you don’t need to see new all-time highs frequently. It’s best to hope for extra volatility to benefit from decrease costs. It’s best to pray for bear markets to purchase shares on sale.

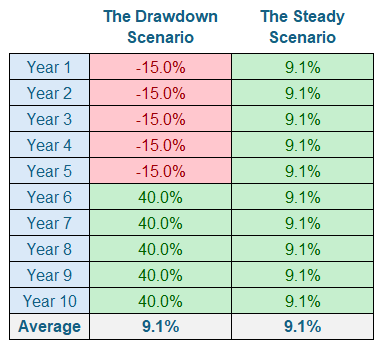

Let’s have a look at a easy instance to place some numbers on it. Listed below are the 2 situations specified by the query at hand:

Each the drawdown and regular situations find yourself with the identical annual return of 9.1%, however the path to get there’s a lot totally different.

So which one is healthier for a saver?

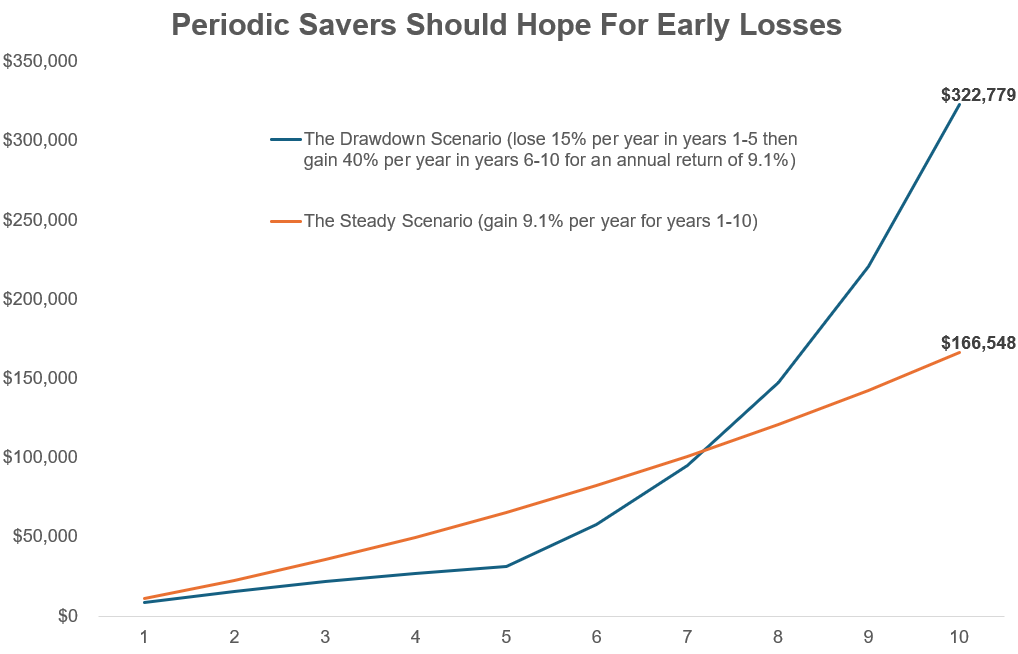

Let’s assume you set $10,000 to work at first of every 12 months for 10 years in every state of affairs.

After 5 years the regular state of affairs is clearly higher. Being down 15% for five years in a row would result in a drawdown of greater than 55%. However have a look at the place issues find yourself after 10 years of saving and investing:

Each situations have the identical quantity invested ($100k in complete) and the identical 10 12 months annualized return (9.1%) however you almost double your cash beneath the early drawdown state of affairs.

How is that this attainable?

You spent 5 years shopping for shares at decrease costs after which they performed catch up over the following 5 years. That’s the dream.

After all, that is a lot simpler to dream about than implement. Not everybody has the intestinal fortitude to take a position when shares are getting hammered.

Plus, you haven’t any management over the sequence of market returns. It’s kind of random and primarily based on luck and timing than anything.

The purpose right here is that totally different dangers matter at totally different instances to totally different traders. There is no such thing as a one-size-fits-all market setting.

You give attention to what you may management, diversify, make good choices again and again, improve the quantity you save annually and do your greatest.

However make no mistake — down markets are a win for younger traders who can be web savers for years to come back. You need markets to fall so you may snap up some screaming offers.

Simply don’t run out of the shop when the whole lot goes on sale.

We dissected this query on the newest version of Ask the Compound:

Callie Cox joined me on the present once more this week to debate questions on investing in options, the plight of the homebuyer, the present state of inventory market valuations, and overcoming monetary errors.

Additional Studying:

What If You Invested on the Peak Proper Earlier than the 2008 Disaster?

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here can be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.