Banks and credit score unions provide financial savings accounts and CDs. Brokers corresponding to Vanguard, Constancy, and Charles Schwab provide cash market funds and Treasuries. They serve related functions at a excessive degree. Each a financial savings account and a cash market fund permit versatile deposits and withdrawals. Each CDs and Treasuries provide a hard and fast rate of interest for a hard and fast time period.

| Banks and Credit score Unions | Brokers | |

|---|---|---|

| Versatile Deposits and Withdrawals | Excessive Yield Financial savings Account | Cash Market Fund |

| Mounted Time period | CDs | Treasuries |

Whereas most discussions on these merchandise from banks and brokers focus on having FDIC insurance coverage or not (see No FDIC Insurance coverage – Why a Brokerage Account Is Secure), many individuals don’t notice that there’s a basic distinction between the roles banks and brokers play. I discussed this distinction in my Information to Cash Market Fund & Excessive Yield Financial savings Account. It’s price highlighting it once more.

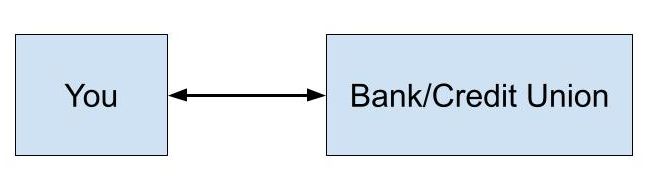

The basic distinction is that banks and credit score unions provide a two-party non-public contract whereas a dealer serves as an middleman between you and the general public market.

Two-Social gathering Personal Contract

A two-party non-public contract means something goes so long as one occasion makes the opposite occasion conform to the phrases. If a financial institution will get you to conform to a 0.04% fee in a financial savings account or a 0.05% fee in a 10-month CD (these are precise present charges from a big financial institution), that’s what you’ll get no matter what the speed ought to be. The financial institution units the speed. They don’t have to justify it. You get a nasty contract should you aren’t conscious of the going fee.

A foul contract doesn’t must be this apparent. It’s been over a 12 months now because the Fed raised the short-term rates of interest above 5%. The speed on a “good” on-line high-yield financial savings account such because the one from Ally Financial institution is presently 4.2% whereas a cash market fund pays 5% or extra. It’s 4.2% from the financial institution solely as a result of the financial institution says so. You’re paying a “familiarity penalty” once you stick with Ally.

I’m not selecting on Ally particularly. It really works the identical at Marcus, Synchrony, Amex, Uncover, Capital One, or Barclays. Ken Tumin, the founding father of DepositAccounts.com, made this statement in April 2024:

Should you take a step again and ask why banks can profit from buyer inertia within the first place, you notice that’s the character of a two-party non-public contract. Prospects should take the initiative to interrupt out of a nasty contract.

Some banks play tips by providing a brand new financial savings account beneath a distinct title with aggressive charges whereas maintaining the speed low on the present financial savings accounts. The speed is low on the present account solely as a result of that’s the contract you agreed to. The financial institution isn’t obligated to maneuver you to the brand new program as a result of that’s not within the contract. Nor does the financial institution must let you know that you could change to the brand new program to get the next fee. It’s as much as you to search out out and take motion.

Charges at many massive credit score unions aren’t any higher. I’m a member of a well-regarded credit score union. It’s the biggest credit score union within the nation by far, with 3 times the belongings of the second-largest credit score union. The speed on its financial savings account is 1.5% when you have got $50,000 within the account. That’s 3.5% decrease than the yield in a cash market fund.

contract immediately can flip into a nasty contract tomorrow. How the contract will change is within the contract itself. A financial institution affords 5.0% APY on a 13-month CD immediately. That’s an OK fee however what occurs after 13 months? You agree within the contract it can mechanically renew to a 12-month CD at a fee set by the financial institution at the moment until you are taking particular actions to cease it inside a brief window. Guess what fee the financial institution will set on its 12-month CD? Virtually all the time a nasty one. It really works this fashion since you agreed to the contract.

When you have got a two-party non-public contract, your curiosity is in direct battle with the opposite occasion within the contract. The onus is on you to know whether or not the contract is nice or unhealthy. It’s on you to look at when a great contract turns into a nasty contract. Caveat emptor. You’ll have to leap from contract to contract should you don’t wish to get caught in a nasty contract.

Some individuals are extra alert in monitoring and leaping. They’ve an opportunity to “beat the market” however they pay for it with a heavy psychological workload and time spent on opening new accounts and shutting previous accounts. Many fail to be vigilant sooner or later. They begin paying the “familiarity penalty” as a result of it’s too tiring in any other case.

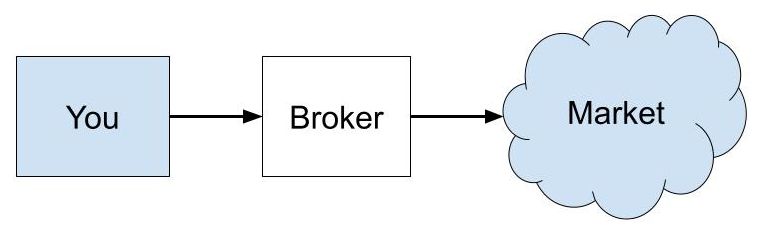

Market Middleman

A dealer acts as an middleman. They get you the market fee and take a minimize. A dealer doesn’t set the speed. The market does. The dealer solely units its minimize.

A cash market fund will get you the market fee on cash market securities minus the minimize by the fund supervisor. Some fund managers take an even bigger minimize than others however the distinction between main gamers is far smaller and extra steady than the distinction between charges provided by totally different banks and credit score unions. Should you use a cash market fund with the smallest minimize, corresponding to one from Vanguard, you virtually assure you’ll have the most effective fee in a cash market fund always.

You continue to pay a “familiarity penalty” once you use a cash market fund from Constancy or Schwab versus one from Vanguard however the distinction is within the 0.2%-0.3% vary whereas the “familiarity penalty” in financial institution financial savings accounts could be greater than 1%. The “familiarity penalty” is zero or negligible in shopping for Treasuries by Constancy, Schwab, or Vanguard.

Treasuries don’t trick you into renewing at a nasty fee. They mechanically pay out at maturity. You’ll get the market fee once you purchase once more. If the dealer affords the “auto roll” characteristic and also you allow it at your selection, your Treasuries will mechanically renew on the market fee. You’ll be able to relaxation assured that you just received’t be cheated.

Cash market funds and Treasuries paid little or no when the Fed saved rates of interest at zero and ran a number of rounds of Quantitative Easing just a few years in the past. That wasn’t cash market funds’ fault or brokers’ fault. These had been the market charges at the moment. Like investing in index funds, you hand over the dream of “beating the market” once you put your cash in cash market funds and Treasuries however you additionally constantly get the market charges always. It doesn’t require maintaining your guard up, monitoring rigorously, or leaping.

If you wish to constantly earn a great yield with low upkeep, ditch banks and credit score unions. Should you usually maintain cash in a financial savings account at a financial institution or a credit score union, put the cash in a cash market fund. Listed below are some selections at Vanguard, Constancy, and Schwab:

Should you usually purchase a CD from a financial institution or a credit score union, purchase a Treasury of the identical time period at Vanguard, Constancy, or Schwab. See How To Purchase Treasury Payments & Notes With out Charge at On-line Brokers and Purchase Treasury Payments & Notes On the Secondary Market.

I used to have many accounts with banks and credit score unions. I’ve solely $60 in financial institution accounts now. My money is in cash market funds and Treasuries in a brokerage account.

The Fed has signaled that they could decrease rates of interest quickly. I don’t suppose they are going to minimize charges all the way in which again to zero once more. If sooner or later banks and credit score unions begin paying extra on their financial savings accounts and CDs than cash market funds and Treasuries, which I doubt will occur, I’ll nonetheless stick with cash market funds and Treasuries as a result of I just like the transparency and equity. I’d slightly get the market fee always than depend on the benevolence of a financial institution or a credit score union.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.