The S&P 500 is up 27% in 2024.

We’re rapidly closing in on a 30% achieve for the calendar yr.

How uncommon is that feat?

It occurs extra usually than you’ll assume.

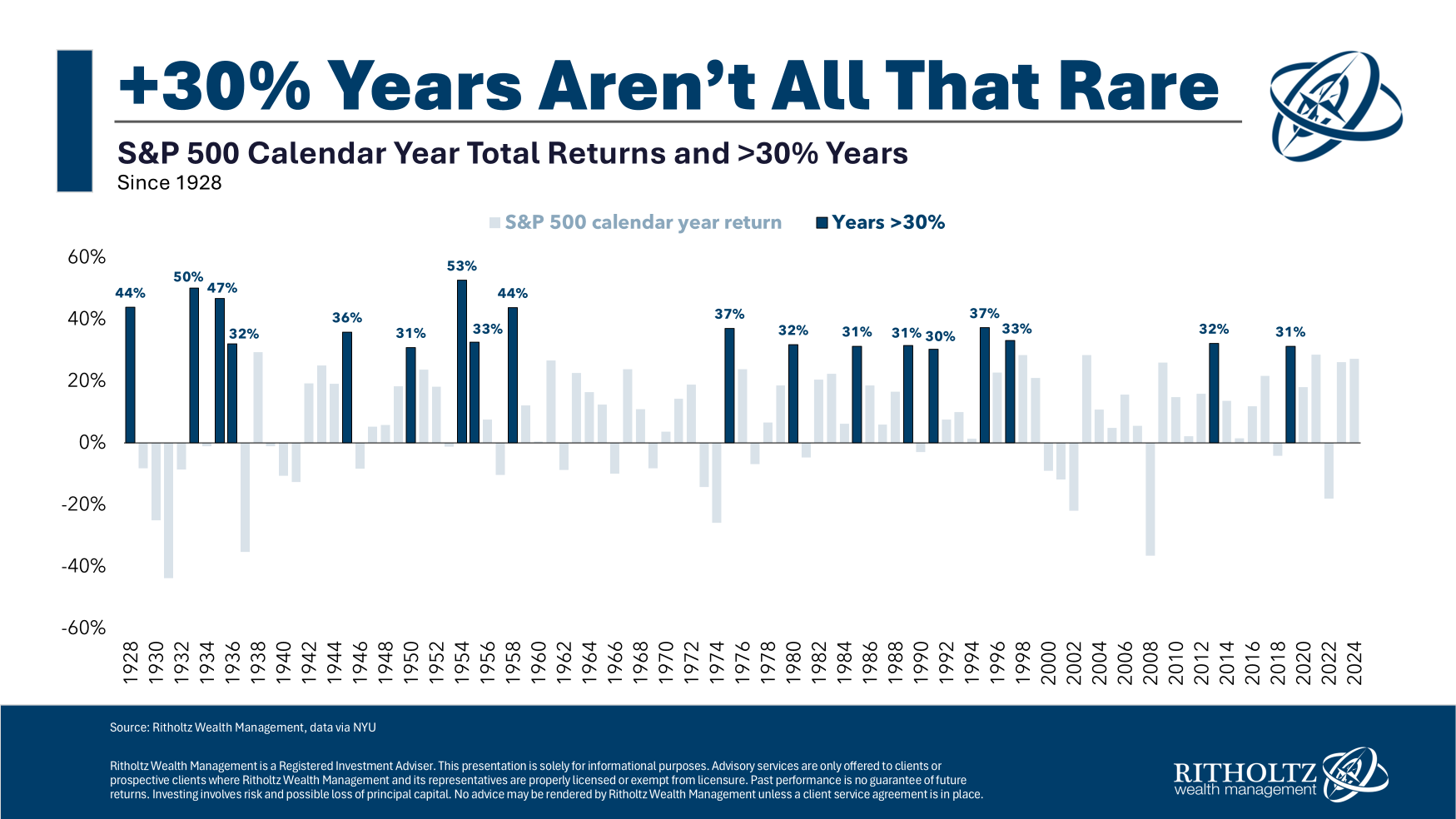

Right here’s a take a look at each calendar yr return on the S&P 500 going again to 1928:

The 30% good points are highlighted.

By my depend, there have been 18 years wherein the inventory market completed with a achieve of 30% or extra. In order that’s roughly 20% of the time or one in each 5 years.

There have been additionally 7 years wherein the S&P 500 completed the yr within the vary of 25% to 30% good points. Meaning 25 out of the previous 96 years have skilled good points of 25% or higher.

That’s a variety of giant good points. There are many buyers who’re euphoric on the present setting however I do know some people who find themselves getting nervous.

Does this spell doom for the inventory market?

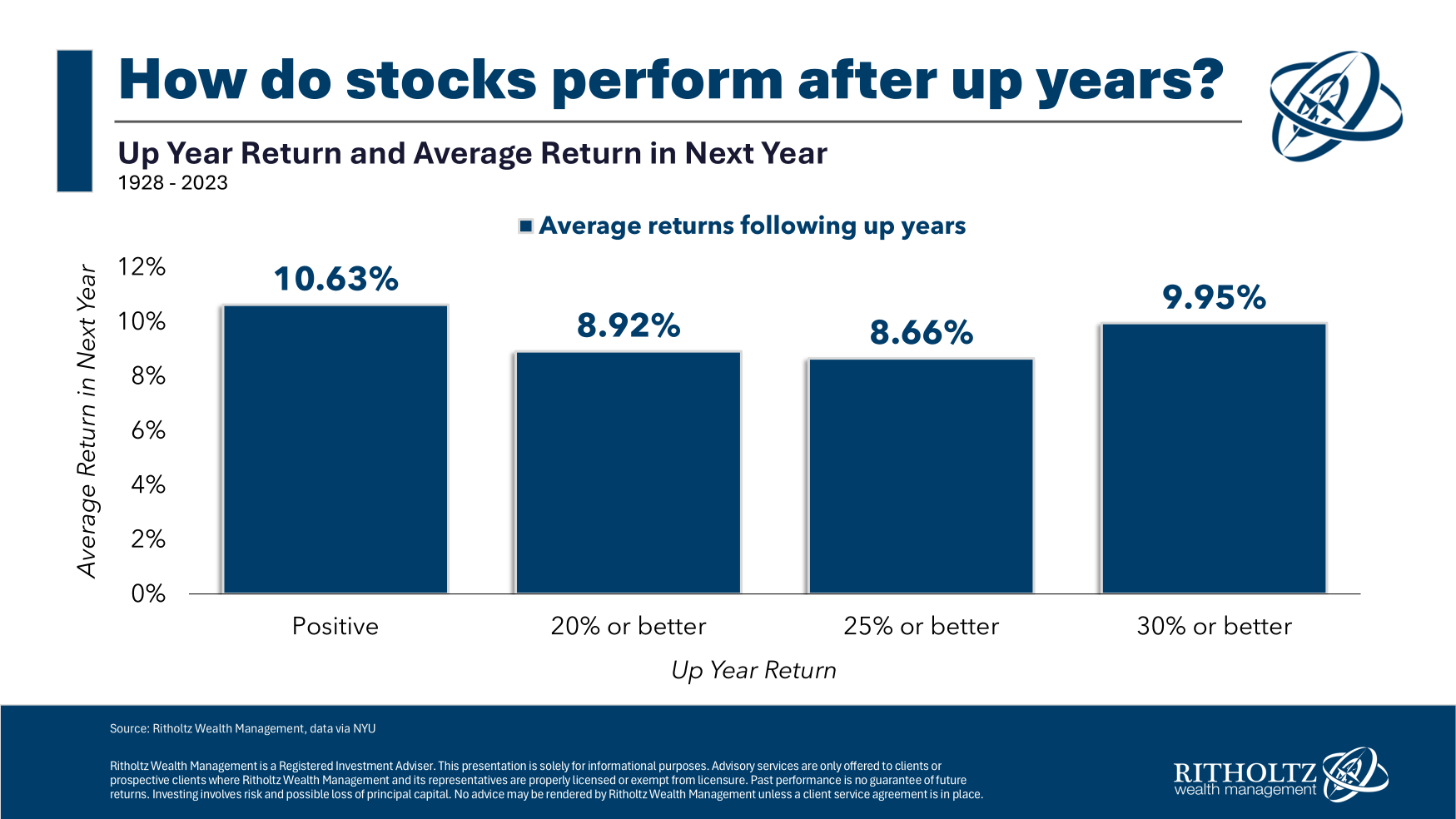

Not essentially. Listed here are the typical returns for the S&P 500 within the yr after an up yr and good points of 20%+, 25%+ and 30% or extra:

There isn’t a variety of sign within the noise right here. The typical return following a 30% achieve on the inventory market is, effectively, common.

It’s tough to foretell the way forward for the inventory market primarily based on short-term strikes in both path.

Listed here are the most effective years throughout this epic bull market run:

- 2009 +26%

- 2013 +32%

- 2017 +22%

- 2019 +31%

- 2020 +18%

- 2021 +28%

- 2023 +26%

- 2024 +27%

If the efficiency holds this yr, that may be three out of the previous 4 years with good points of 25% or extra. It might even be 5 out of the previous 6 years with double-digit good points. To be truthful, 2022 was a double-digit down yr so it hasn’t been all sunshine and rainbows.

This has been an unbelievable run for U.S. giant cap shares.

I don’t know when it should come to an finish however I do know it will probably’t final perpetually.

Nevertheless, it is very important perceive massive up years within the inventory market are nothing to be afraid of.

They occur extra usually than you assume.

Additional Studying:

3% Inventory Market Returns For the Subsequent Decade?

This content material, which accommodates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.