Though I stopped chasing financial institution and brokerage bonuses, it’s nonetheless a sound approach to make some cash. You possibly can simply make $5,000 or extra annually with a big sufficient account. The bonus can fund nice-to-have toys or experiences or just add to your long-term investments.

I’m not saying you must or shouldn’t do it. If you happen to’re however haven’t carried out it earlier than, listed below are some pointers that can assist you pull it off extra simply.

The Massive Image

Some brokers wish to entice new prospects and extra actions. Providing a bonus to precise prospects may be simpler than spending thousands and thousands on promoting. You obtain a bonus from the dealer by taking part within the promotion. They get to indicate development to Wall Avenue. Win-win.

Select a Bonus Promotion

Many promotion affords are listed in Greatest Brokerage Bonuses on the Physician of Credit score weblog at any time. Some affords are from bigger brokers you’ve heard of. Some are from smaller brokers you didn’t know. All affords require that you just maintain the transferred property on the new dealer for a while. I might favor affords from a bigger establishment with a shorter required holding interval.

For example, as I’m penning this, Webull affords a 2% bonus with a 2-year holding interval and Wells Fargo affords a $2,500 bonus for transferring $250,000. Though Webull’s bonus is twice as massive ($5,000 versus $2,500 for transferring $250,000), Wells Fargo’s promotion solely requires holding the transferred property for 90 days. You get the bonus sooner and the property can transfer once more after 90 days to earn one other bonus elsewhere. Wells Fargo can also be a better-known establishment than Webull. I might choose Wells Fargo’s supply over Webull’s.

Switch an IRA

If the promotion doesn’t exclude IRAs, it’s simpler to switch an IRA than a taxable brokerage account. Though the associated fee foundation for holdings in a taxable account ought to switch over to the brand new dealer, there’s a threat that it doesn’t or it’s tousled by the switch. You keep away from this threat by transferring an IRA (both Conventional or Roth), the place the associated fee foundation doesn’t matter.

If the bonus is paid into an IRA, it counts as earnings within the IRA. You possibly can nonetheless obtain the bonus within the IRA even when you already maxed out the IRA contributions for the yr otherwise you’re not eligible to contribute. If the bonus is paid right into a Conventional IRA, it’s not taxable now but it surely’ll be taxable once you ultimately withdraw from the Conventional IRA. The bonus shall be tax-free if it’s paid right into a Roth IRA. The particular Wells Fargo promotion I used for instance pays the bonus right into a checking account, which makes it taxable, however different promotions often pay the bonus to the account transferred.

There aren’t any tax penalties once you match the IRA sort to switch: Conventional-to-Conventional or Roth-to-Roth. There received’t be any 1099 kinds for the switch.

Transferring an IRA avoids issues in any other case current in a taxable account. As a result of an IRA is at all times in just one individual’s identify, when you’re married, you and your partner can join the promotion individually and double up on the bonus by transferring your respective IRAs.

Determine Shares to Switch

You don’t must switch your entire IRA. Determine some shares that you just received’t contact. These shares can go to the brand new dealer.

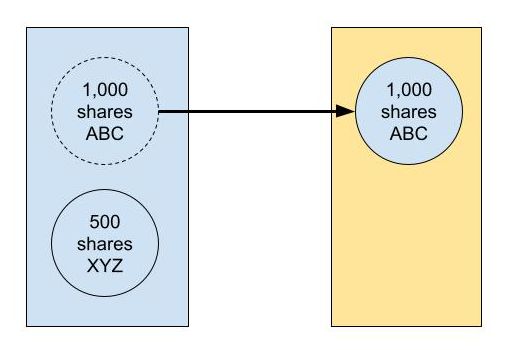

Don’t promote the shares. You’re solely shifting the identical shares “in type” from one dealer to a different. Suppose you might have 1,000 shares of an ETF ABC. You progress these 1,000 shares of ABC to a different dealer. You continue to have 1,000 shares of ABC in your new account. You don’t promote your shares. The worth of those shares will fluctuate however they’ll be the identical whether or not they stayed within the unique account or they’re held in a distinct account.

Particular person shares and ETFs are simpler to switch than mutual funds. Particular person bonds and brokered CDs may be transferred as nicely. They go by their CUSIP numbers, that are equal to the ticker symbols of shares and ETFs. Maintain any money in your present account.

If you happen to intend to commerce among the shares, go away these within the present account. Rebalancing and withdrawing from the IRA often entails solely a small proportion of your holdings. For instance, suppose you might have 1,000 shares in a holding, 800 shares may be transferred to the brand new dealer. You employ the remaining 200 shares in your present IRA to rebalance or take withdrawals.

The thought is that you just’ll break up your IRA into an “at-home” account and a “touring” account. You continue to do all the pieces you usually do within the “at-home” account that you just’re already aware of. The “touring” account incorporates holdings you received’t contact. It travels from one place to a different to earn bonuses. You received’t do any buying and selling within the “touring” account on the new dealer apart from turning on computerized dividend reinvestment. You don’t must learn the way the brand new account works. It solely sits idle ready for the bonus.

Open a New Account

After you establish which IRA and which shares you’ll switch, you open an empty new account of the identical sort on the new dealer. Remember to learn the promotion necessities. This half is crucial to obtain the bonus. If it’s good to enter a promo code once you open the account, embrace the promo code. If you happen to should use a selected hyperlink, use the hyperlink. If you happen to should go to a department, go to a department. If it’s a combo deal that requires you to open each a checking account and an funding account, be sure that the 2 accounts are correctly linked (that is the case in Wells Fargo’s promotion I used for instance).

Ensure to match the precise spelling of your identify and your Social Safety Quantity between your present and new accounts. Arrange your on-line login, password, and 2-factor authentication on the new dealer. Designate beneficiaries on your new IRA.

Affirm with customer support that your account is coded for the bonus promotion. Save any promotion enrollment affirmation emails.

Submit Switch Request

Inter-broker transfers undergo a system known as ACATS, which stands for Automated Buyer Account Switch Service. You at all times provoke it on the receiving dealer. You give them your account quantity on the sending dealer with a latest account assertion. You request a partial account switch with a listing of the positions and the variety of shares you recognized. It takes every week or two to finish.

If the promotion requires you to finish the switch by a sure date, make sure to not miss the deadline.

If the sending dealer expenses you a switch price, you’ll be able to request a reimbursement from the receiving dealer. In the event that they don’t reimburse you, chalk it up as being coated by the switch bonus you’ll obtain.

Flip On Dividend Reinvestment

Activate dividend reinvestment on the new dealer after your transferred property arrive. Now the brand new account will run on autopilot whereas it waits for the bonus.

Set Calendar Reminders

Set a calendar reminder for once you count on the bonus to indicate up based mostly on the phrases of the promotion plus 7-10 days. I obtained the promised bonus in all of the promotions that I participated in earlier than. A few of them might need been late by a couple of days however they at all times got here.

Set one other calendar reminder for when your property are free to maneuver once more with out dropping the promotion bonus. Give a liberal buffer. If the promotion requires a 90-day holding interval, maintain your property on the new dealer for 120 days. Search for the subsequent vacation spot on your “touring” account after you’ve totally happy the phrases of the promotion. Your subsequent switch generally is a full-account switch of this “touring” account to its subsequent vacation spot.

***

It takes a while to plan and execute for the primary time but it surely isn’t too troublesome. It will get simpler the second time or the third time round. You determine whether or not it’s value making $5,000 a yr with this endeavor.

Say No To Administration Charges

In case you are paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.