When Ted Benna found a change within the tax code that may enable staff and employers to make tax-deferred retirement contributions within the late-Nineteen Seventies, it could change the retirement business in immeasurable methods.

The automated investing revolution has absolutely impacted the inventory market with the arrival of standard automated contributions, rebalancing and a one-stop store for broad diversification (targetdate funds).

Outlined contribution retirement plans have additionally supplied ample ammunition for monetary advisors. In an outlined profit world of pension plans, there’s not as a lot want for monetary recommendation on retirement planning.

However when everyone seems to be on their very own in relation to retirement, it’s an entire new world.

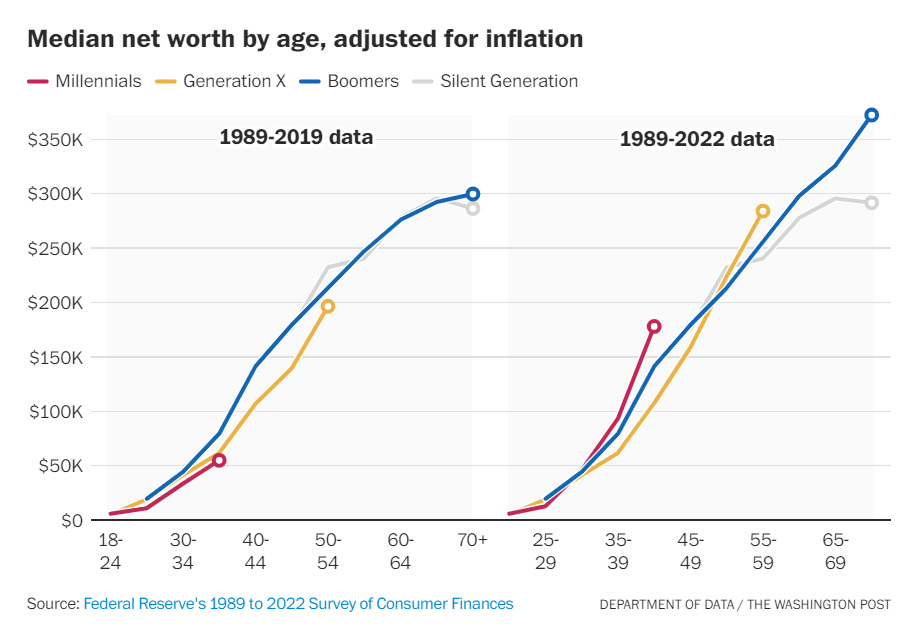

The Washington Submit not too long ago checked out wealth by technology on the identical age over time:

A number of issues stand out from these charts:

- There was an enormous surge in wealth between 2019 and 2022.

- Millennials and Gen X are actually forward of Child Boomers and the Silent Technology on the identical age.

- Whereas the Silent technology noticed their wealth stagnate of their 60s, Child Boomer wealth is accelerating as they age.

There are extenuating circumstances in any comparability like this, however Child Boomers are price practically $80 trillion. Ten thousand members of this technology will retire each day between now and the top of this decade.

Retirement is a scary proposition for a lot of due to all of the uncertainties concerned within the course of.

In a 2022 earnings name, former Morgan Stanley CEO James Gorman said, “In a decade, we’ll look again at this agency and say that our office enterprise was essentially the most important technique change. I actually imagine that the retirement house is the subsequent frontier.”

Morgan Stanley manages one thing like $1.5 trillion of property of their wealth administration division. And their huge focus is on boring outdated retirement plans. Why?

There’s now $12 trillion1 tied up in outlined contribution retirement plans (401k, 403b, 457, and so forth.).

A very good chunk of this cash will likely be transferring and in want of monetary recommendation within the years forward. In 2023 alone, there was $765 billion in IRA rollovers from these plans.

That cash wants monetary planning, funding administration, tax planning, property planning, retirement withdrawal methods and extra.

Outlined contribution retirement plans are an unlimited alternative for monetary advisors and it’s not simply these in or approaching retirement age.

When you’re an advisor, you’ll be able to’t simply anticipate finding these purchasers when it’s time to get that gold watch.2 By the point the rollovers start, most of that cash is already spoken for.

You need to plant the seed early in the event you hope to advise on outlined contribution retirement property from the HENRYs of the world who’re slowly however absolutely constructing wealth over the lengthy haul.

I talked to Shawn O’Brien, Director of Retirement at Cerulli Associates, in regards to the large alternatives outlined contribution retirement plans present for monetary advisors on The Unlock:

We’re ramping up content material for monetary advisors at The Unlock. When you’re a monetary advisor, subscribe to The Unlock right here. We’re doing deep dives into greatest practices, business analysis, wealth tech, and development insights that we’ve by no means shared anyplace else.

We’ve bought loads of nice stuff coming so that you don’t wish to miss out.

Additional Studying:

The Computerized Investing Revolution

1There’s one other $13 trillion in IRA property.

2Is that also a factor when folks retire?

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.