Finance Minister Nirmala Sitharaman offered the Union Finances 2024-25 in Parliament on Tuesday. Hopes have been excessive that the Modi authorities would introduce substantial tax reforms benefiting the center class and salaried people. Nevertheless, the FM prevented making any main tax reduction bulletins, with just a few modifications beneath the New Tax Regime. In her seventh consecutive funds, the FM elevated the Customary Deduction from Rs 50,000 to Rs 75,000 and adjusted the tax slabs beneath the brand new tax regime. The federal government didn’t elevate the fundamental tax exemption limits or introduce new deduction advantages beneath the brand new tax regime, which has already been adopted by two-thirds of taxpayers.

New Tax Regime (Revised)

Right here’s a comparability of the charges revised within the new tax regime. People incomes as much as ₹3 lakh yearly shouldn’t have to pay any earnings tax.

| Tax Slab for FY 2023-24 | Tax Charge | Tax Slab for FY 2024-25 | Tax Charge |

| As much as ₹ 3 lakh | Nil | As much as ₹ 3 lakh | Nil |

| ₹ 3 lakh – ₹ 6 lakh | 5% | ₹ 3 lakh – ₹ 7 lakh | 5% |

| ₹ 6 lakh – ₹ 9 lakh | 10% | ₹ 7 lakh – ₹ 10 lakh | 10% |

| ₹ 9 lakh – ₹ 12 lakh | 15% | ₹ 10 lakh – ₹ 12 lakh | 15% |

| ₹ 12 lakh – ₹ 15 lakh | 20% | ₹ 12 lakh – ₹ 15 lakh | 20% |

| Greater than 15 lakhs | 30% | Greater than 15 lakhs | 30% |

Moreover, the usual deduction for salaried people has been elevated to ₹75,000 from ₹50,000.

Taxpayers with a taxable earnings of ₹7 lakh can declare a rebate of as much as ₹25,000 beneath Part 87A. The outdated regime stays unchanged, permitting a rebate of ₹12,500 for people incomes as much as ₹5 lakh beneath the identical part.

Which earnings tax regime is best?

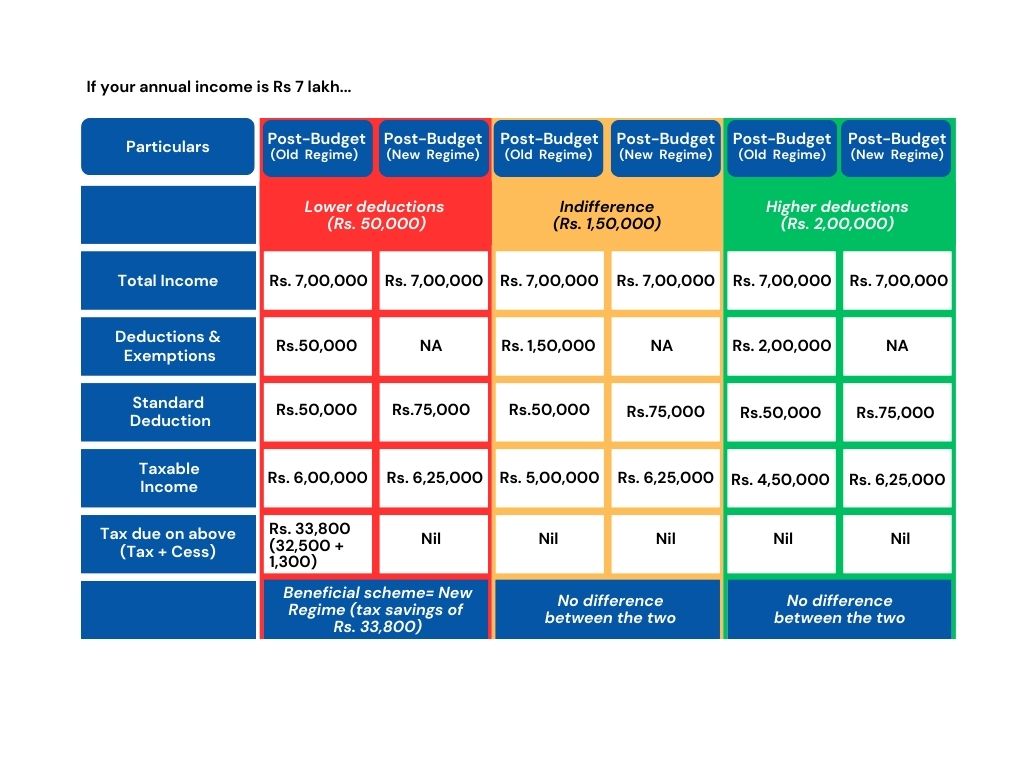

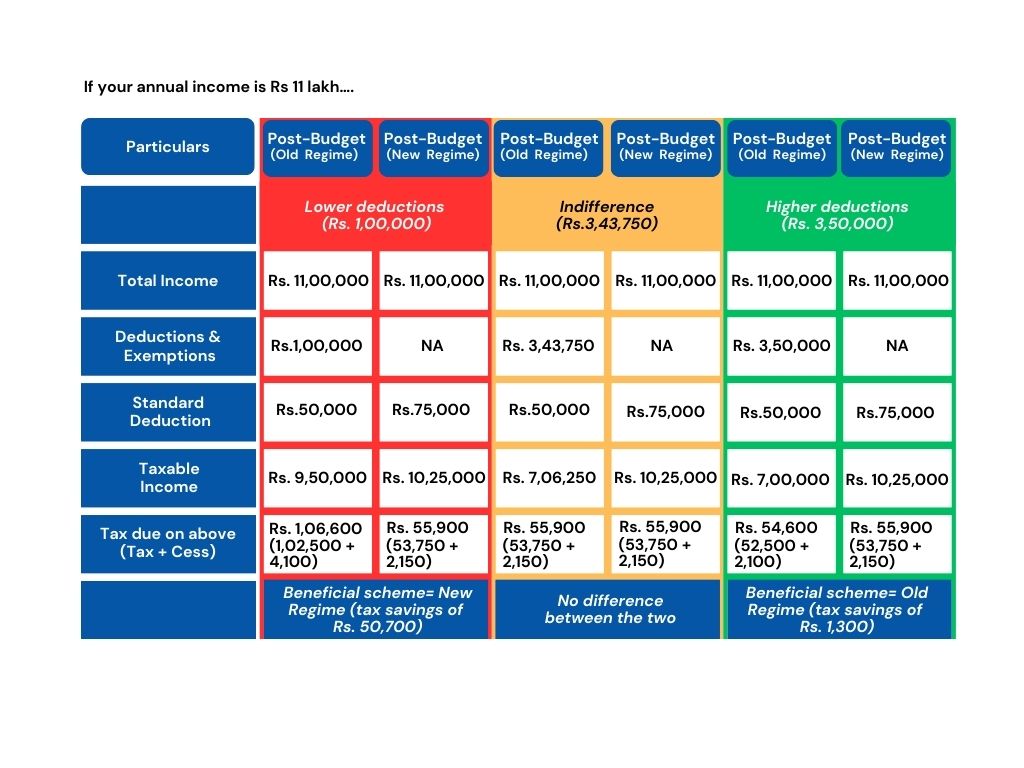

With the revised tax slabs and an elevated normal deduction, taxpayers are eager to grasp the impression of those modifications and decide which regime fits them greatest.

The selection between the brand new and outdated tax regimes is dependent upon particular person circumstances, notably the supply and extent of deductions.

For decrease earnings ranges, the brand new regime is extra advantageous as a result of larger rebate, which exempts taxpayers with a taxable earnings of as much as ₹7 lakh, in comparison with ₹5 lakh beneath the outdated regime. For these incomes lower than ₹7 lakh, the brand new tax regime can cut back their tax outgo to zero. A salaried worker incomes as much as ₹7.75 lakh won’t must pay any taxes in any respect beneath the brand new tax regime, because of the elevated deduction of ₹75,000.

For people with considerably larger incomes, comparable to ₹5 crore, the brand new and simplified tax regime is extra useful. The tax payable on this earnings is decrease because of a lowered surcharge price of 25 %, in comparison with 37 % beneath the outdated regime.

The next desk illustrates which regime is extra useful at numerous earnings ranges and the way one can obtain parity between the 2 regimes by claiming the required deductions beneath the outdated regime.

Calculations for FY 2024-25:

Notes:

- The above charges are used for resident people (lower than 60 years of age).

- Tax outgo beneath the brand new and outdated regimes might be zero for taxable incomes of as much as Rs. 7 lakh and Rs. 5 lakhs respectively as a result of rebate u/s 87A.

- These incomes don’t embrace any earnings taxable beneath particular charges.

- “Indifference level” is the extent of deductions at which your tax outgo beneath the outdated regime might be at par with that beneath the brand new regime.

- In case your deductions are larger than the “Indifference level”, the outdated regime is useful. In any other case, the brand new regime.

- For these within the lowest and highest tax brackets, the brand new regime might be useful.

- Surcharge charges are the identical beneath outdated and new tax regimes, apart from earnings above Rs. 5 crores for which the surcharge price is 37% beneath the outdated regime as in comparison with 25% beneath the brand new regime.

Conclusion

The revised new regime proves to be an even bigger deterrent to staying on within the outdated regime. Whereas the outdated regime has extra deductions that encourage investing and insuring, the tax brackets are additionally a lot larger. To maintain your taxes as little as the brand new regime, you might want to have important deductions.

So, when you declare a number of important deductions beneath the outdated regime, comparable to home-loan curiosity or home hire allowance (HRA), your tax legal responsibility might be decrease. For low-income earners and people with fewer deductions, the brand new, simplified regime will rating.