In December 2020 I wrote a brief historical past of chasing the most effective performing funds.

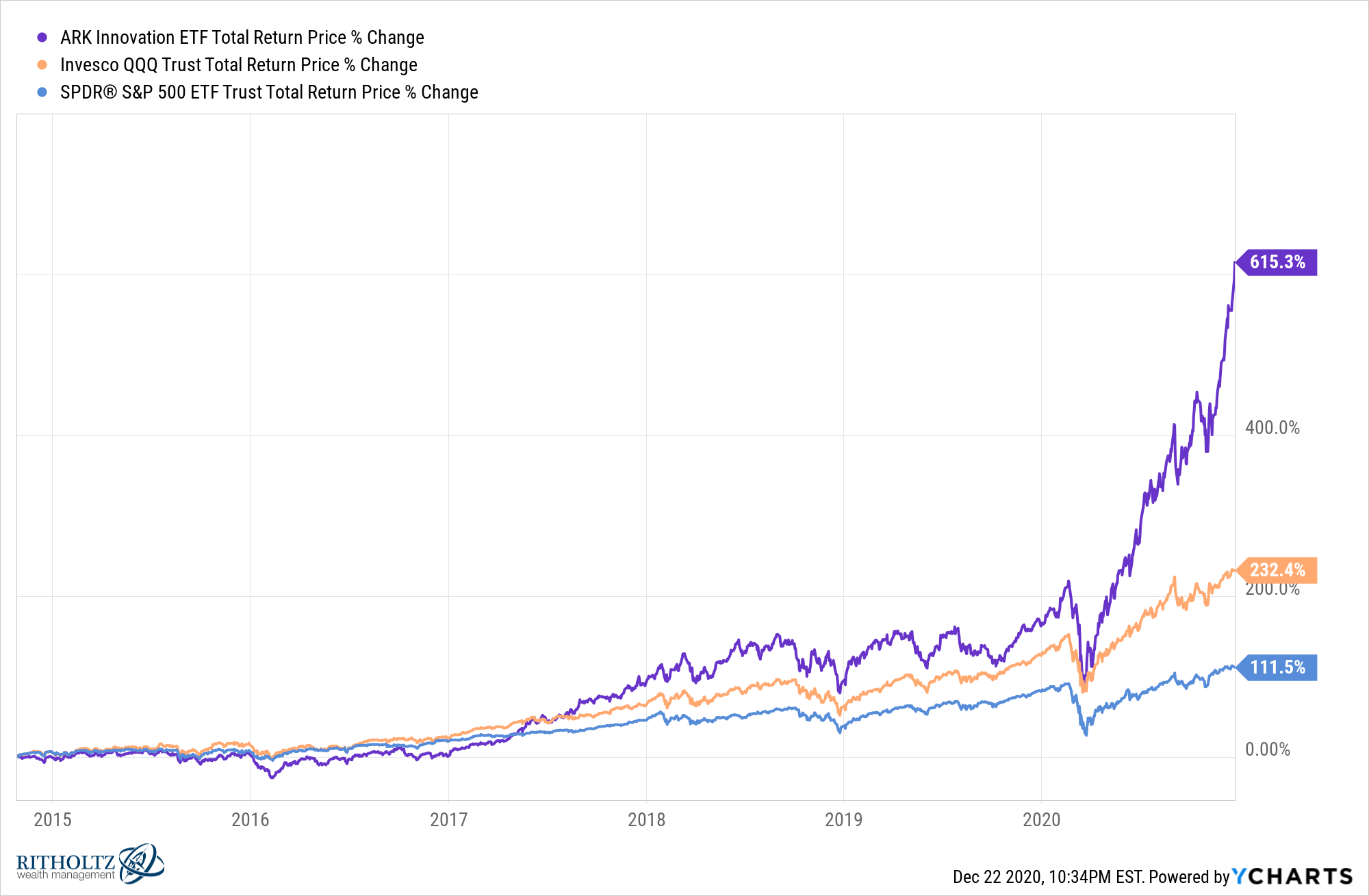

On the time, Cathie Wooden’s ARK Innovation fund was on hearth, completely destroying the market:

Wooden rapidly turned some of the well-known fund managers alive. She was within the headlines daily. Her inventory picks and pronouncements concerning the future had been reported by each monetary media publication within the nation.

Traders took discover. Billions of {dollars} flooded in. The fund went from rather less than $2 billion initially of 2020 to $18 billion by 12 months finish. A few of that was value appreciation. Most of it was traders chasing the new dot.

Right here’s what I wrote on the time:

ARKK can not outperform at this tempo eternally. There’s sure to be a misstep or the model will merely fall out of favor for a time period. Most of the traders chasing the new dot will head for the exits at that time.

Traders don’t have an incredible monitor report in relation to chasing the most popular fund of the day.

I hate to be that individual, however I’ve seen this film earlier than and it ends with a conduct hole.

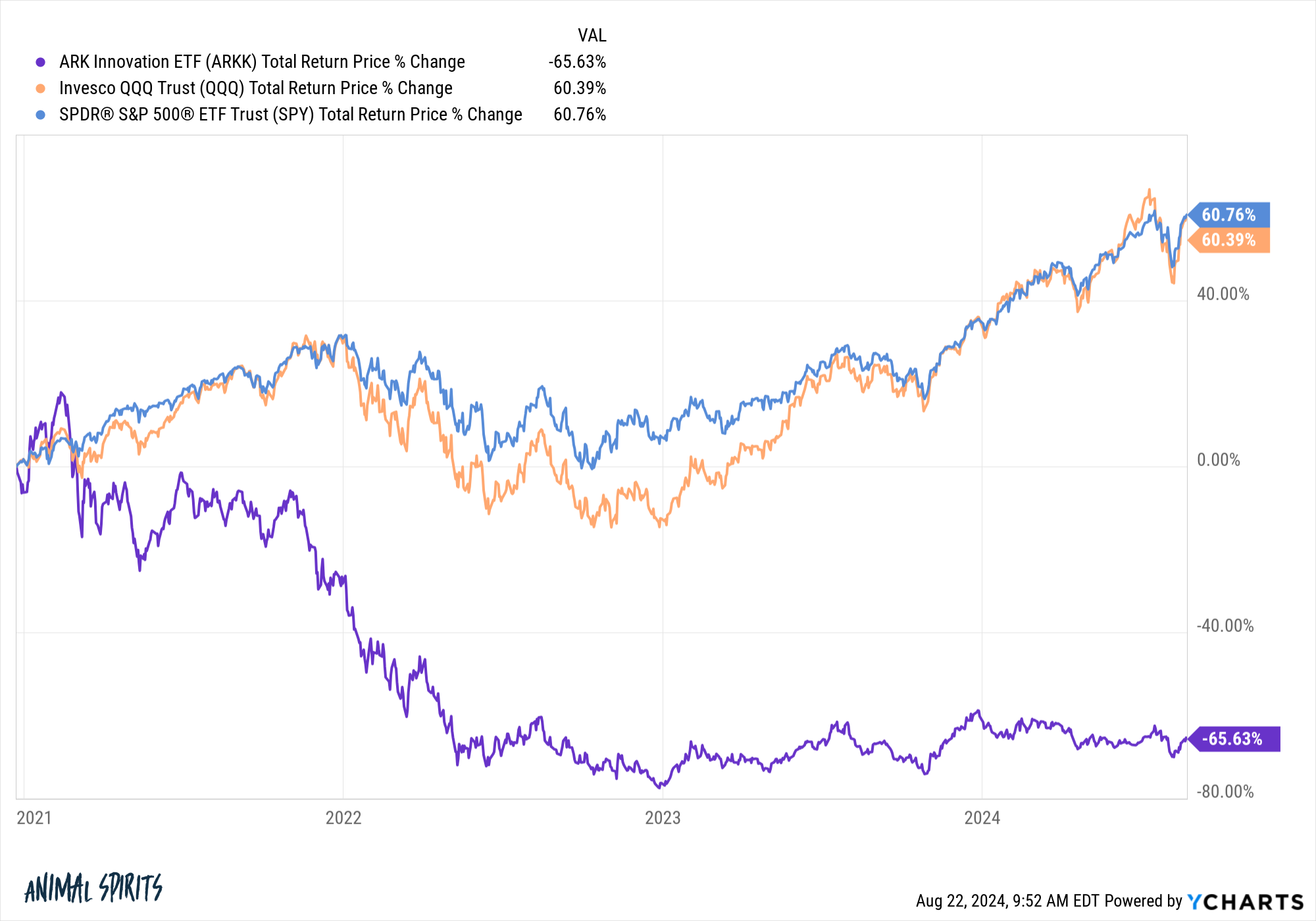

I assumed ARKK needed to underperform as a result of nobody has the flexibility to maintain up that form of run with cash flowing in like a tsunami. I’m undecided I assumed the underperformance can be as nice because it has been.

These are the returns since I wrote that piece on the tail finish of 2020:

The fund has been decimated.

What makes it all of the extra shocking is that this occurred within the midst of an AI increase (that some are already calling a bubble). An innovation fund missed out on maybe the largest innovation of this decade and past.

As all the time, beating the market is tough.

Belongings peaked in early-2021 at near $30 billion:

The timing by traders right here was predictably godawful.

You had a spectacular run of efficiency which introduced in a flood of cash. That was adopted by horrible efficiency which was inevitably adopted by cash speeding to the exits.

This can doubtless go down as one of many largest investor greenback losses in historical past.

Morningstar’s Jeffrey Ptak reveals the fnud has misplaced traders $7.5 billion since inception:

Now, this doesn’t imply the fund itself has been underwater since its inception. Whereas ARKK has underperformed the S&P 500 and Nasdaq 100, the returns going again to the beginning of the fund are optimistic:

It’s simply that traders all obtained on the boat proper earlier than a big storm hit.

This was a textbook case of a star fund supervisor who was on a heater that was sure to finish sooner or later. Traders couldn’t have timed it any worse.

Chasing star fund supervisor efficiency is nothing new.

It has occurred earlier than.

It’ll occur once more.

It’s human nature.

Michael and I talked concerning the historical past of star portfolio managers and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

A Quick Historical past of Chasing the Finest Performing Funds

Now right here’s what I’ve been studying currently:

Books:

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.