I’m a neat freak, so sometimes, I clear out my workplace and re-organize.

Whereas doing so earlier this week I got here throughout an previous Life journal a reader despatched me a variety of years in the past.

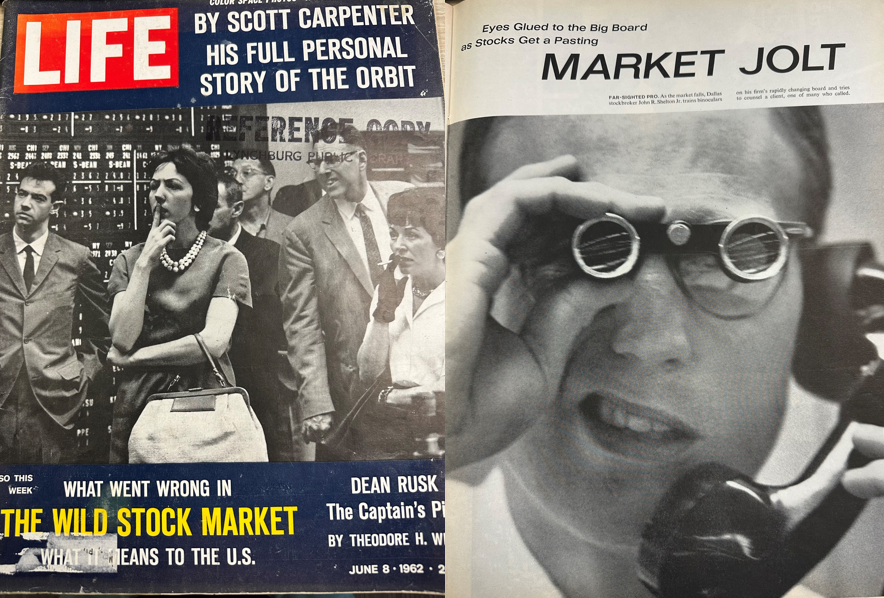

It’s from June 1962 and the inventory market was the duvet story:

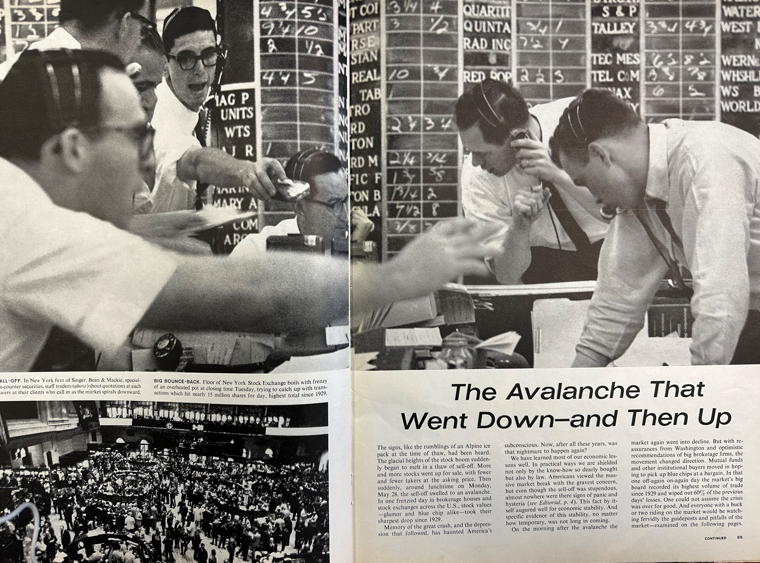

The photographs are unbelievable.

So was the lede of the story:

The indicators, like rumblings of an Alpine ice pack on the time of thaw, had been heard. The glacial heights of the inventory growth all of the sudden started to soften in a thaw of sell-off. An increasing number of shares went up on the market, with fewer and fewer takers on the asking value. Then all of the sudden, round lunchtime on Monday, Could 28, the sell-off swelled to an avalanche. In a single frenzied day in brokerage homes and inventory exchanges throughout the U.S., inventory values — glamour and blue chip alike — took their sharpest drop since 1929.

Within the spring of 1962, the inventory market was already within the midst of a double-digit correction. Then on Could 28, there was a flash crash, sending shares down almost 7% in a single day. It was the most important in the future sell-off because the Nice Melancholy.

Why did it occur?

Right here’s the reason from the article:

There can solely be one actual reply: the market got here down as a result of it had gone too excessive.

The rationale the market went so excessive after which selected this specific time to stumble will get into some mysteries of human psychology. Each scholar of the market is aware of that the worth of shares at any given second relies upon extra on the temper of the investor than on anything.

Generally the rationale shares fall is as a result of they rose an excessive amount of within the first place. There was an enormous bull market within the Nineteen Fifties. Traders have been doubtless complacent and in want of a comeuppance.

The inventory market can act like a lunatic within the quick run as a result of human feelings are fickle.

It’s changing into clearer by the day that final Monday’s inventory market swoon was additionally a flash crash. As of August 5, the S&P 500 was down greater than 6% for the month. It’s now optimistic in August.

I’m not ruling out additional volatility forward however that mini-flash crash seems like a freakout second by buyers. There are all kinds of macro causes one can level to for that freakout — a slowing labor market, Japan elevating charges, the carry commerce unwind, a doable Fed misstep on financial coverage, and many others.

However probably the most logical purpose for final Monday’s inventory market turmoil is the market got here down as a result of issues have been too calm. The inventory market can not keep calm without end.

Flash crashes occurred within the Nineteen Twenties, they occurred within the Sixties they usually occur in the present day.

The largest distinction between from time to time is the interconnected nature of the worldwide markets. You’ve gotten laptop and algorithmic buying and selling. Info flows on the velocity of sunshine. Each piece of financial knowledge is parsed in real-time with a fine-tooth comb.

Overreactions can occur a lot quicker now.

Simply have a look at the most important hole downs over the previous 40+ years:

This chart exhibits the most important distinction between the opening value of the inventory market and the prior day’s shut. All of them have occurred this decade outdoors of the 1987 crash.

We had the third largest VIX spike ever throughout a 9% correction:

This was a monetary crisis-level volatility eruption and we by no means even hit double-digits on the drawdown.

I can’t predict the longer term, however I wouldn’t be stunned if all these occasions happen extra regularly going ahead.

Human nature is the one fixed throughout all market environments however we’re not buying and selling with hand-written commerce tickets and chalkboards anymore.

The data age has added a Barry Bonds degree of HGH to human nature within the markets.

We’re prone to see extra of those flash crashes sooner or later resulting from a mixture of elevated leverage within the system, globalized markets and laptop buying and selling.

The exhausting half for buyers is that it’s now simpler to lose management throughout all these market occasions. You don’t must name your dealer on the telephone to put a commerce. You’ll be able to change your whole portfolio in your telephone with the push of a button.

Simply because markets are getting quicker doesn’t imply your choices have to be made quicker.

In a world that’s dashing up by the day, it’s extra necessary than ever to take it gradual on the subject of your investments.

Michael and I talked about flash crashes and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Minsky Market

Now right here’s what I’ve been studying recently:

Books: