When the housing market crashed within the early 2000s, new mortgage guidelines emerged to stop the same disaster sooner or later.

The Dodd-Frank Act gave us each the Capacity-to-Repay Rule and the Certified Mortgage Rule (ATR/QM Rule).

ATR requires collectors “to make an inexpensive, good religion willpower of a shopper’s means to repay a residential mortgage mortgage in keeping with its phrases.”

Whereas the QM rule affords lenders “sure protections from legal responsibility” in the event that they originate loans that meet that definition.

If lenders make loans that don’t embody dangerous options like interest-only, destructive amortization, or balloon funds, they obtain sure protections if the loans occur to go unhealthy.

This led to most mortgages complying with the QM rule, and so-called non-QM loans with these outlawed options turning into rather more fringe.

One other widespread characteristic within the early 2000s mortgage market that wasn’t outlawed, however grew to become extra restricted, was the prepayment penalty.

Given prepayment threat right this moment, maybe it may very well be reintroduced responsibly as an possibility to save lots of householders cash.

A Lot of Mortgages Used to Have Prepayment Penalties

Within the early 2000s, it was quite common to see a prepayment penalty hooked up to a house mortgage.

Because the identify suggests, householders had been penalized in the event that they paid off their loans forward of schedule.

Within the case of a tough prepay, they couldn’t refinance the mortgage and even promote the property throughout a sure timeframe, sometimes three years.

Within the case of a delicate prepay, they couldn’t refinance, however might brazenly promote each time they wished with out penalty.

This protected lenders from an early payoff, and ostensibly allowed them to supply a barely decrease mortgage charge to the patron.

In spite of everything, there have been some assurances that the borrower would possible preserve the mortgage for a minimal time frame to keep away from paying the penalty.

Talking of, the penalty was usually fairly steep, reminiscent of 80% of six months curiosity.

For instance, a $400,000 mortgage quantity with a 4.5% charge would lead to about $9,000 in curiosity in six months, so 80% of that might be $7,200.

To keep away from this steep penalty, householders would possible cling on to the loans till they had been permitted to refinance/promote with out incurring the cost.

The issue was prepays had been usually hooked up to adjustable-rate mortgages, some that adjusted as quickly as six months after origination.

So that you’d have a state of affairs the place a house owner’s mortgage charge reset a lot larger and so they had been basically caught within the mortgage.

Lengthy story quick, lenders abused the prepayment penalty and made it a non-starter post-mortgage disaster.

New Guidelines for Prepayment Penalties

Immediately, it’s nonetheless doable for banks and mortgage lenders to connect prepayment penalties to mortgages, however there are strict guidelines in place.

As such, most lenders don’t hassle making use of them. First off, the loans should be Certified Mortgages (QMs). So no dangerous options are permitted.

As well as, the loans should even be fixed-rate mortgages (no ARMs allowed) and so they can’t be higher-priced loans (1.5 proportion factors or greater than the Common Prime Supply Price).

The brand new guidelines additionally restrict prepays to the primary three years of the mortgage, and limits the charge to 2 % of the excellent steadiness pay as you go throughout the first two years.

Or one % of the excellent steadiness pay as you go throughout the third yr of the mortgage.

Lastly, the lender should additionally current the borrower with an alternate mortgage that doesn’t have a prepayment penalty to allow them to evaluate their choices.

In spite of everything, if the distinction had been minimal, a shopper may not need that prepay hooked up to their mortgage to make sure most flexibility.

Merely put, this laundry checklist of guidelines has principally made prepayment penalties a factor of the previous.

However now that mortgage charges have surged from their document lows, and will pull again a good quantity, an argument may very well be made to carry them again, in a accountable method.

Might a Prepayment Penalty Save Debtors Cash Immediately?

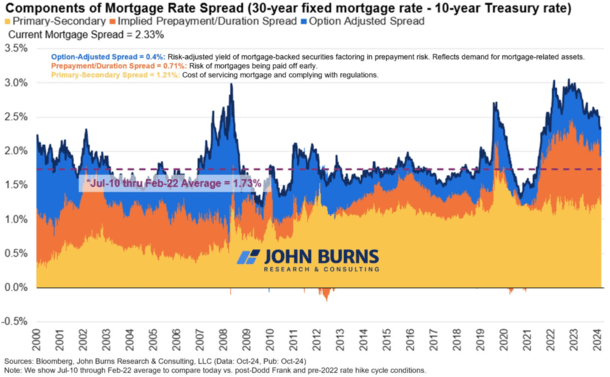

These days, mortgage charge spreads have been a giant speaking level as a result of they’ve widened significantly.

Traditionally, they’ve hovered round 170 foundation factors above the 10-year bond yield. So if you happen to wished to monitor mortgage charges, you’d add the present 10-year yield plus 1.70%.

For instance, right this moment’s yield of round 4.20 added to 1.70% would equate to a 30-year fastened round 6%.

However due to latest volatility and uncertainty within the mortgage world, spreads are practically 100 foundation factors (bps) larger.

In different phrases, that 6% charge may be nearer to 7%, to account for issues like mortgages being paid off early.

Lots of that comes right down to prepayment threat, as seen within the chart above from Rick Palacios Jr., Director of Analysis at John Burns Consulting.

Lengthy story quick, quite a lot of householders (and lenders and MBS traders) count on charges to return down, regardless of being comparatively excessive for the time being.

This implies the mortgages originated right this moment received’t final lengthy and paying a premium for them doesn’t make sense in the event that they receives a commission off months later.

To alleviate this concern, lenders might reintroduce prepayment penalties and decrease their mortgage charges within the course of. Maybe that charge may very well be 6.5% as an alternative of seven%.

Ultimately, a borrower would obtain a decrease rate of interest and that might additionally cut back the probability of early reimbursement.

Each due to the penalty imposed and since they’d have a decrease rate of interest, making a refinance much less possible until charges dropped even additional.

After all, they’d have to be applied responsibly, and maybe solely provided for the primary yr of the mortgage, perhaps two, to keep away from turning into traps for householders once more.

However this may very well be one approach to give lenders and MBS traders some assurances and debtors a barely higher charge.