In case you’ve been paying consideration, you will have seen that mortgage charges have quietly crept again as much as almost 7%.

Whereas it appeared that these 7% mortgage charges have been a factor of the previous, they appeared to return simply as shortly as they disappeared.

For reference, the 30-year mounted averaged round 8% a yr in the past, earlier than starting its descent to almost 6% in early September.

It appeared we have been destined for five% charges once more, then the Fed price minimize occurred. Whereas the Fed itself didn’t “do something,” their pivot coincided with some optimistic financial studies.

Mixed with a “promote the information” occasion of the Fed minimize itself, charges skyrocketed. Nonetheless, now is likely to be a great time to remind you that charges do are inclined to fall for some time after price cuts start.

Falling Charges Usually Play Out Over Years, Not Months

As famous, the Fed pivoted, aka lowered its personal fed funds price, in September. They did so after growing their price 11 instances throughout a interval of tightening.

Therefore the phrase “pivot,” as they swap from elevating charges to decreasing charges.

Briefly, the Fed decided financial coverage was sufficiently restrictive, and it was time to loosen issues up. This tends to end in decrease borrowing charges over time.

Whereas many falsely assumed the pivot would result in even decrease mortgage charges in a single day, these “within the know” knew these cuts have been principally already baked in, a minimum of for now.

So when the Fed minimize, mortgage charges truly drifted slightly larger, although not by a lot. The true transfer larger post-cut got here after a better-than-expected jobs report.

Recently, unemployment has taken heart stage, and a robust labor report tends to level to a resilient financial system, which in flip will increase bond yields.

And since mortgage charges monitor the 10-year bond yield rather well, we noticed the 30-year mounted leap larger.

After almost hitting the high-5s in early September, it utterly reversed course and is now knocking on the 7% door once more.

How is that this attainable? I believed the excessive charges have been behind us. Nicely, as I wrote earlier this month, mortgage charges don’t transfer in a straight line up or down.

They will fall whereas they’re rising, and climb when they’re falling. For instance, there have been instances once they moved down a complete proportion level throughout their ascent in 2022.

So why is it now stunning that they wouldn’t do the identical factor when falling? It shouldn’t be in case you zoom out slightly, however most can’t keep the course and include their feelings from dramatic strikes like this.

It Can Take Three Years for Mortgage Charges to Transfer Decrease After a Fed Pivot

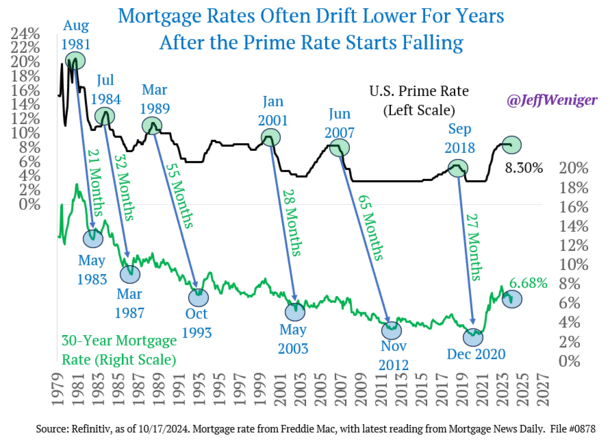

WisdomTree Head of Equities Jeff Weniger crafted a extremely attention-grabbing chart just lately that checked out how lengthy mortgage charges are inclined to fall after the prime price begins falling.

He graphed six situations when charges got here down from 1981 by means of 2020 after prime was lowered. And every time, aside from in 1981, it took a minimum of two years for charges to hit their cycle backside.

If we mix all these falling mortgage price intervals and use the typical, it took 38 months for them to maneuver from peak to trough.

In different phrases, greater than three years for charges to hit their lowest level after an preliminary Fed minimize.

Because it stands now, we’re solely a month into the prime price falling. Nevertheless it’s vital to notice that charges had already fallen from round 8% a yr in the past.

They’ve now drifted again as much as round 6.875%, and it’s unclear in the event that they’ll proceed to maneuver larger earlier than coming down once more.

However the takeaway for me, in agreeing with Weniger, is that we stay in a falling price atmosphere.

Even when 30-year mounted charges hit 7% once more, it’s decrease highs over time as charges proceed to descend.

That means we noticed 8% in October, 7.5% in April, and maybe we’ll see 7% this month. However that’s nonetheless a .50% decrease price every time.

The following cease could possibly be 6.5% once more, then 6%, then 5.5%. Nonetheless, it received’t be a straight line down.

Nonetheless, it’s vital to concentrate to the longer-term pattern, as an alternative of getting caught up within the day-to-day motion.

Mortgage Lenders Take Their Time Decreasing Charges!

I’ve stated this earlier than and I’ll say it once more for the umpteenth time.

Mortgage lenders will all the time take their candy time decreasing charges, however received’t hesitate in any respect when elevating them.

From their perspective, it makes excellent sense. Why would they stick their neck out unnecessarily? May as properly sluggish play the decrease charges in the event that they’re unsure the place they’ll go subsequent.

As a lender, in case you’re in any respect fearful charges will worsen, it’s greatest to cost it in forward of time to keep away from getting caught out.

That’s seemingly what is occurring now. Lenders are being defensive as ordinary and elevating their charges in an unsure financial atmosphere.

If and once they see softer financial knowledge and/or larger unemployment numbers, they’ll start decreasing charges once more.

However they’ll by no means be in any rush to take action. Conversely, even a single optimistic financial report, akin to the roles report that received us into this example, shall be sufficient for them to lift charges.

In different phrases, we would want a number of comfortable financial studies to see mortgage charges transfer meaningfully decrease, however only one for them to bounce larger.

So in case you’re ready for decrease mortgage charges, be affected person. They’ll seemingly come, simply not as shortly as you’d anticipate.